FreshBooks accounting software is a free invoice software that caters to small business accounting. FreshBooks invoice provides a variety of services to many industries. These services include marketing, legal services, and business consulting, trades and home services, information technology, and many more. After knowing who owns FreshBooks, you must also know who owns it. Let’s have a look over another subheading.

FreshBooks is an online accounting software providing you with the best cloud solutions for small business owners to manage finance well. The very first thing drawing your ’s attention is that over five million businesses use it for time tracking and client invoicing.

Who owns FreshBooks?

The co-founder of FreshBooks is Mike. He is the FreshBooks CEO as well. The world’s number one cloud-based best accounting software used by self-employed professionals is none other than FreshBooks.

It was actually built-in 2003. This was done when he accidentally saved over an invoice. Mike took approximately 3.5 years to give proper growth to FreshBooks from his parents’ vault.

There exist some important points of FreshBooks which are discussed below.

FreshBooks: Main highlights

- About 30+ Million people have used FreshBooks worldwide, the very popular cloud accounting app for small business.

- 160+ countries have businesses using FreshBooks

- It offers a broad range of features, from cloud-based small business invoicing to an online payment gateway making invoice simple.

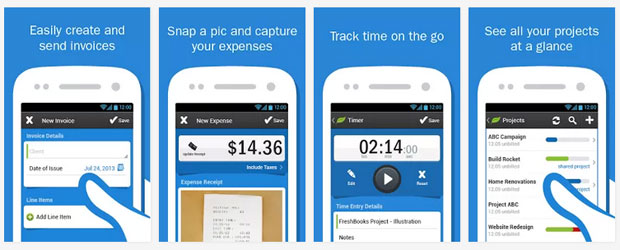

- When users want to do quick expense tracking, they can easily snap a picture of receipts or link to a bank.

- You can make a transfer of your timesheet data to invoice. Thus, you can collect payments fastly.

- The customer support of FreshBooks received the Gold medal in 2014 (Stevie Awards for Sales & Customer Service).

Features of FreshBooks

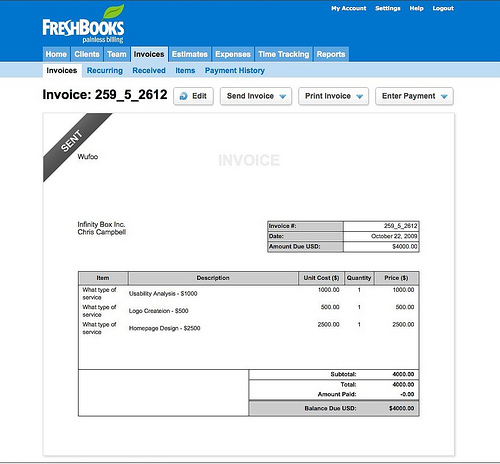

Excellent invoice to complete the payment successfully

FreshBooks provides an excellent online invoice system which serves beneficial to small companies. It alerts you when your client has opened your invoice email. Thus your customers can’t deny that they didn’t receive the invoice. This ensures the proper delivery of your invoice to your clients.

You can easily manage your billing history using many tools and online invoice templates. This bookkeeping software also helps you to keep track of past and current invoices. For example, you can quickly search the unpaid invoices from past months.

Tracking of Expenses Easily

This feature is very useful when it comes to liquidating expenses after a client meeting. You can easily know which expense belongs to which client.

Also, FreshBooks allows you to import expenses directly from your bank. This is done by using the Expense Tool and linking it to your credit card or bank account. Thus, you can track the amount of money your company spends each day.

Time tracking of work and payments in detail

Charging fees is a detailed and verifiable process in FreshBooks small business software which is really beneficial if you need to dispute a payment. If you are in the field, you can take advantage of FreshBooks’ Android or iOS app. Through this, you can precisely record your working time.

It is also simple to modify your work timesheet to an invoice and send it to your clients. The billing features of FreshBooks are also flexible. Your team members can log in their time individually for each project. It can help you in tracking individual and overall time progress as well.

FreshBooks Makes it Simple to Create Reports

Using FreshBooks invoicing software, you can generate financial reports by simply processing the entered data. You can also generate a profit & loss report with some simple clicks.

FreshBooks simplifies the taxation process too. It enables you to generate accurate tax reports by filtering through your financial records. Not only this but also you can also export your reports to a CSV file or other file format to share with a tax adviser or accountant.

There is a new technological feature that can help you use FreshBooks personal accounting software and that is FreshBooks App.

FreshBooks App

Powerful features of FreshBooks App are mentioned as:

- Creating professional invoices

- Send invoice in a professional look

- Receipts’ snap pictures

- Manage expenses on the go

- Stay on top regarding the important business updates

- Chat with clients efficiently

- Sync data across almost all devices

If you are a business owner, you must know about FreshBooks invoicing that can make your transactions, billings simpler.

FreshBooks Invoice

FreshBooks accounting system makes small business invoicing and billing simple and easy. You’ll be amazed to know how much faster you get paid. It helps in creating professional-looking invoices for your business. It is quite simple to even customize your invoice and add your logo. Your clients will feel just wow. It is an online invoice tool beneficial for small business software.

Other Recommended Articles:

How to Change Master Admin in QuickBooks Online

How to Set Up QuickBooks Online Bank Rules

How to Enter and Pay Bills in QuickBooks Online

How do I pay a FreshBooks invoice?

For FreshBooks Payments:

- Email is used to send an invoice to your client.

- They can see a Pay Online button at the top and bottom of the Invoice.

- Once they click upon it, it will take them to the Secure Payment page.

- Now the client is required to enter their credit card details. The payment will be completed by clicking on the Pay Now option.

- When the process is completed successfully, the invoice will be marked as paid.

After discussing FreshBooks features, highlights, and uses, now comes FreshBooks pricing that can enable you to decide your budget for it.

Best Invoice Maker Apps on Playstore to Create Invoices on Mobile

Stripe QuickBooks Integration: Connecting QuickBooks and Stripe

How to Make and View Adjusting Journal Entries in QuickBooks

FreshBooks Pricing

There are 3 plans in FreshBooks:

- Lite

- Plus

- Premium

The cost of each plan is $15, $25, and $50 per month respectively. These plans have basic accounting features like invoicing, payment processing, and time tracking.

| Plans | Monthly Pricing | Annual Pricing |

| Lite | $15 | $13.5 |

| Plus | $25 | $22.5 |

| Premium | $50 | $45 |

| FreshBooks Select | Customized | Customized |

As NEW YEAR SALE, they are providing 60% off on the actual price of all the plans. The offer is for a limited time, so you should try checking it out once.

When the billing cycle is initiated, the annual plans are paid in a lump sum.

FreshBooks Select with customized pricing is a new pricing feature of FreshBooks for all those who have more than 500 clients. It can be also useful for those who have bills over $150,000/year.

Though each accounting software is so good to use and advantageous for business people, we know that it may also have cons. Look forward to the Pros And Cons of FreshBooks.

Pros And Cons of FreshBooks

Pros

- Freshbooks is easy to use accounting software.

- It allows you to invoice clients, track time and expenses through your cloud account on FreshBooks.

- This payroll software keeps records of all payments and expenses.

- Sends out friendly reminders to clients to alert them that they have not paid yet.

- The client can’t deny if he has opened and viewed the invoice because it can be trackable by you easily.

- Freshbooks creates well-defined reports that can help your accountant at tax time.

Cons

- If you are thinking that FreshBooks is a full-service solution for your bookkeeping, then you are highly mistaken. It doesn’t allow you to track income quickly and easily. First, you have to add dummy accounts and then you require to manually add the information.

- FreshBooks doesn’t allow any staff member in your account unless it gets a payment of at least $39.95 along with tax each month.

- If you really wish to eliminate the limit on the number of clients, then first you have to pay at least $29.95 as well as tax per month.

- It doesn’t even allow your clients to deposit payments into your bank account.

Conclusion

There are many businessmen but not every one of them will be at that “building stage” of their business journey that can lead to success directly. That’s okay. If you are conquering your day-to-day tasks of creating invoices and payments collection, then FreshBooks is the magic wand that you’re searching for.

Who should be using FreshBooks

- Freelancers

- Self-Employed Professionals

- Businesses With Contractors

- Businesses With Employees

Hence, it is concluded that this bookkeeping software offers you top-quality accounting solutions like free invoice templates along with great customer support as well as flexible pricing.