One wrong transaction can affect your accounts and land you in trouble. Here we will assist you in how you can delete and undo reconciliation in QuickBooks Online Accountant, QuickBooks Online, and QuickBooks Desktop versions. Along with this, you will get the reasons, benefits, and more about undo reconciliation. Read the article and get answers to all your questions.

Before moving on, let’s see when you need to undo a reconciliation and what are its advantages.

When would you undo a reconciliation?

Errors made while creating a transaction require you to reverse the reconciled transaction instantly. Here are some scenarios in the list when you need to undo reconciliation. Let’s have a look at this.

- The transaction was recorded for an incorrect date.

- To ensure that any uncleared check is not remaining.

- To find hidden bank errors.

- To check whether there is any forced reconciliation of bank statements.

- The bank reconciliation was forced and now needs to be corrected systematically.

Advantages of Undo Reconciliation

Let’s discuss the advantages of undo reconciliation in QuickBooks. Some of the advantages are mentioned below.

- Quickly spot fluctuations in income and respond accordingly.

- Take quick, informed, and decisive actions when there are any financial opportunities or possible signs of danger.

- If there are possibilities of risk, you can take major actions.

- Can catch bank errors that could cost you money, like a wrong total for a deposit with multiple checks.

- Prevention of possible fraud by employees, accounting professionals, or vendors.

Other Recommended Articles:

QuickBooks ProAdvisor Certification Exam Questions PDF Sample: Be a Certified Expert

5 Best Software for Inventory Management for ECommerce Business

How to Update QuickBooks Desktop

How can you Undo Reconciliation in QuickBooks?

To undo the effect of QuickBooks reconciliation, you need to log in and open the QuickBooks. After that open the reconciliation report for which you want to make changes. Now you are ready to proceed.

Here we have mentioned the process of how can you undo reconcile the transaction in QuickBooks Online Accountant, QuickBooks Online, and QuickBooks Desktop.

Steps to Undo Reconciliation in QuickBooks Online Accountant (QBOA)

Here we discussed how to undo reconciliation in QuickBooks Online Accountant.

Before doing undo reconciliation, make sure you are making the right changes because you can undo one transaction at a time. One mistake can unbalance your accounts, so follow each step carefully. Let’s start.

- Sign in to the QuickBooks Online Accountant and open the company file.

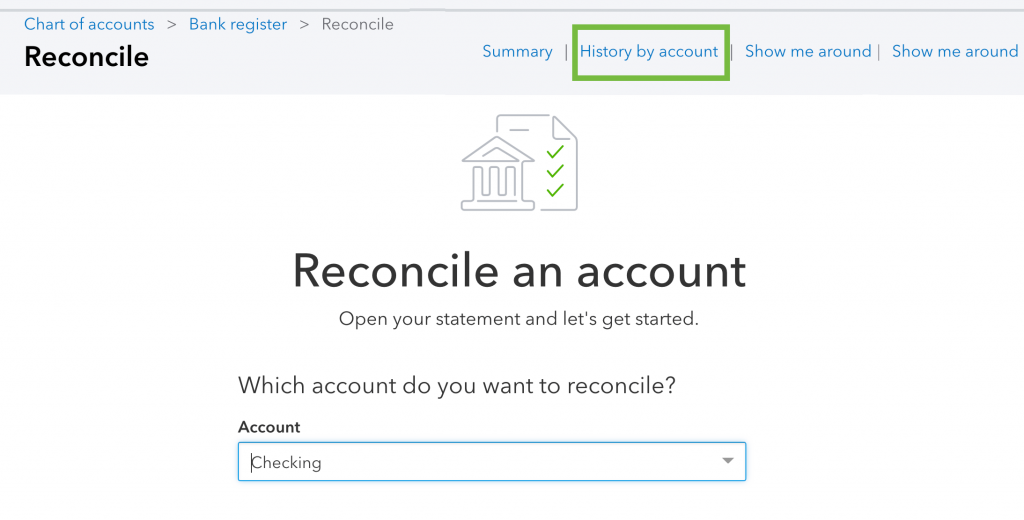

- Here go for the ‘Accounting‘ menu, and then select the ‘Reconcile‘ tab.

- Choose the ‘History by account‘ option.

- In the next step, choose the account that you need to reconcile and the date range from the list.

- Open the reconciliation report and click on the ‘View Report‘ option.

- Then review any discrepancies and make a change your client wants to make.

- Now in the ‘Action‘ column, select the dropdown, and then click ‘Undo‘.

- At last, click on the ‘Yes‘ option and then click on the ‘Undo‘ option to confirm it.

How to Undo Transactions from Reconciliation in QuickBooks Online

Now we are going to discuss steps to undo reconciliation in QuickBooks Online. Follow the procedure and undo and remove your transactions from reconciliation in QuickBooks Online.

- At the first step, you should review your opening balance, beginning balance, and the ending balance for the account to ensure that you have chosen the right transaction to undo.

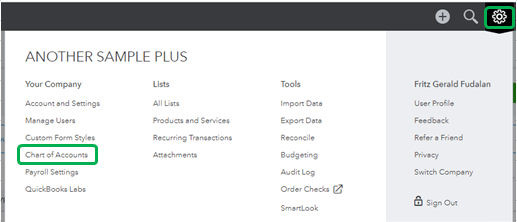

- After the complete review process, go for the ‘Accounting‘ menu.

- Select the ‘Chart of Accounts‘ option from the ‘Accounting‘ menu.

- Then search for the account and click on the ‘View Register‘ option.

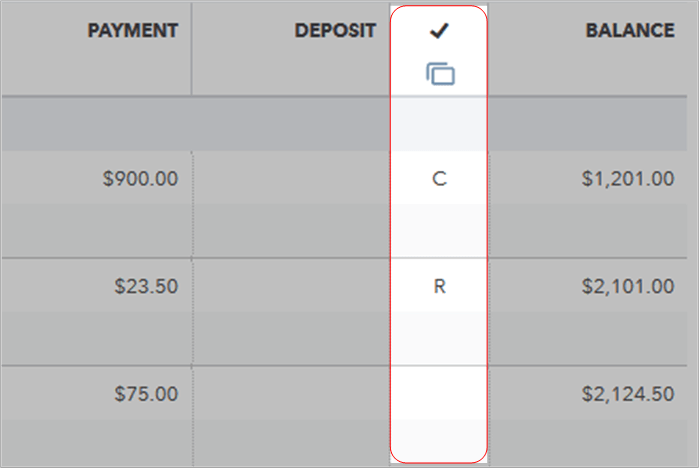

- You will see ‘R‘ in the checkmark column if the transaction is reconciled.

- Uncheck the box next to ‘R’.

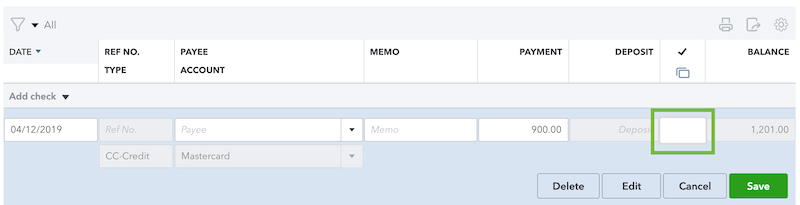

- After that click on the ‘Save‘ option and close the register.

- And adjust the reconciliation or enter an adjusting Entry.

- Go to the left menu, and choose the ‘Accounting‘ tab for the ‘Reconcile‘ option.

- After that, reconcile your account.

- After reviewing, click start reconciling.

- Now from the drop-down menu, click the ‘Finish Now‘ option.

- And confirm the adjustment date.

- In the next step, click on the ‘Add adjustment and Finish‘ option, and click on the ‘Done‘ option.

How to Delete Reconciliation in QuickBooks Online

Here, we will discuss the process of deleting the reconciliation in QuickBooks Online. You can do it by following the instructions as same as given.

- Open ‘QuickBooks Online’ and choose ‘Registers’ from the ‘Banking’ menu.

- Select the account from the ‘Register Name’ drop-down list.

- Click on the transaction you wish to undo reconciliation for.

- Delete the ‘R’ letter at the top of the transaction in order to change its rank to Unreconciled.

How to Undo Last Reconciliation in QuickBooks Desktop Edition?

In this, we will discuss how you can undo the previous reconciliation in QuickBooks Desktop. Follow the steps to do so.

- Sign in and open the QuickBooks.

- Go to the ‘Banking’ menu and find the company file you want to undo.

- Click on the ‘Reconcile now’ option.

- In the end, click the option ‘Undo Last Reconciliation’.

Let’s understand how to undo reconciliation in QuickBooks in detail through this video.

How can I Edit Previous Reconciliation in QuickBooks?

Sometimes we made mistakes while creating the transactions, and worry about the solutions. But you can easily edit the transactions. Here we have described the edit proceed for reconciliation in QuickBooks. Let’s have a look and apply it to your issue.

- Open QuickBooks and Click on the Accounting tab from the side menu.

- Select Chart of Accounts. Find the bank account and click View register.

- Find and choose the transaction you want to edit and then hit Edit.

- Make the changes and click on the Save button.

- Click on the Yes button to confirm.

- If you have another transaction, repeat the same for the rest.

Frequently Asked Questions (FAQs)

Why I can’t find reconcile undo option?

Undo option is only available for the QuickBooks Online Accountant version. For the other versions, you need to undo the transactions manually. We have discussed both the method above you can check. But before that, it is important to know that manual reconciliation affects the beginning bank balance. So it is good to consult an accountant who can deal with such kind of situation.

How can I restore deleted reconciled transactions affecting the opening balance?

Deleting a transaction can mess up the reconciled balance. So, it is necessary to correct it as soon as possible. Because over time it becomes more difficult to find and fix the error. Here’s how you can restore the deleted reconciled transactions.

- After opening QuickBooks, go to the setting and click Audit log.

- Click the Filter drop-down and choose the date when the transaction was deleted.

- Select Show only these events button and tick the transactions checkbox.

- From the Show drop-down, click Deleted/ Voided transactions.

- Click Apply and select view to the deleted transaction.

We have discussed the steps to undo reconcile the transactions in QuickBooks all information you need to know about it. If you fail to solve the issue or have any queries, connect with our QuickBooks ProAdvisor. Our expert team will support you quickly and help you to solve the QuickBooks issue. Contact by dialing our toll-free number +1-844-405-0904.