Are you a small business or a big business and want to integrate sales and accounting data? You want to know does Pipedrive integrate with Quickbooks in the first place, so the answer is yes, now If you’re looking for Pipedrive Integration with Quickbooks then you are in the right place. We created a blog for this topic and after following the steps that we mentioned in the blog you can easily do Pipedrive Quickbooks integration. We also added images, so you don’t have a problem following the steps.

Introduction of Pipedrive

Have you still not heard about Pipedrive, well let me tell you it is a CRM tool that is used most widely by organizations for managing their sales pipeline. It has a better user-friendly interface than other tools in the market. You can see the entire sales process from lead acquisition to deal closure.

The following tasks are done by Pipedrive:

- Visual and Customizable Pipeline—It has a drag and drop function, and you can add custom field and stages, so all three helps you to configure the pipeline according to your requirements.

- Activity Notifications — You can schedule all your sales activities.

- Contact Past—You can view every contact, deal, email, call, note, and meeting participant in your history.

- Segmenting Leads: By categorizing, filtering, sorting, and segmenting leads, you can make lists of people you want to follow up with.

- Team Management: It assists in coordinating tasks and sharing sales accomplishments.

- Revenue Forecasting: It helps in recalculating deals for updates and anticipates sales and revenue depending on your pipeline.

- Web Forms: Helps to design adaptable web forms for your website to produce leads for your lead pipeline.

- Reporting and Dashboards: Help to receive in-depth information on your sales and crucial activities, and analyze processes against your goals on dashboards.

- Email Integration: You can integrate with Gmail, outlook, and other mail services and can send, receive, and track emails.

Introduction of Quickbooks

There are so many accounting software in the market right now, but Quickbooks is even better among them. As it is widely used accounting software mostly by small businesses for keeping track of income and expenses, managing invoices and payments, generating financial reports, and streamlining the process of tax preparation to submission. It mainly automates most processes of bookkeeping and accounting hence reducing the risk of errors, making it more efficient hence saving time as well as money.

They have plans for mid and big organizations too. While some business owners use Quickbooks themselves, others prefer to have an internal or external bookkeeper. They have many plans nowadays but at first, they have Quickbooks Desktop which is used by most businesses, and they have Quickbooks Online which uses a cloud-based service. I will explain both, so you can understand the difference between them.

Quickbooks Desktop

Quickbooks Desktop is more traditional as this is the first product they have launched and the most widely used accounting software that you download and install on your computer. You pay around $549.99 as an annual fee for the Desktop version. They have a mobile app too, but it only has one of the many functions of uploading receipts and not so much and Only gives access to 200-plus apps.

Quickbooks Online

Quickbooks Online is the cloud-based accounting software made for modern businesses that require the real-time collaboration of data and access to their file from any device whether it’s Mac, Windows, or Tab, Mobile. For this version, you have to pay $315 per year. It gives access to over 650 plus apps, and you can create custom rules for bank transactions, which automatically update and categorize for you.

The online app they have is more robust in comparison to the desktop version. The two versions are independent of each other, which means the data you enter on the Desktop doesn’t sync to the Online version and vice versa.

Why Integrate Pipedrive and Quickbooks

So why do we want to integrate Pipedrive with Quickbooks in the first place? The value we got after integration is more than before integration, so I have provided some reasons down below to show you how it provides you with more value.

Automate the Records Creation

It automates record creation and synchronizes your customer’s Quickbooks data, sales information, and payments records. Hence, eliminating the need for manual work saves time, reduces the risk of errors, and ensures accurate and consistent data across systems

Streamline sales-to-accounting workflow

As you are consolidating the customer’s data in one place by centralizing their customer and financial data, meaning tracking payments from customers from invoicing to collection. This integration helps in seamless synchronization of sales data which streamlines the sales to accounting workflow, enabling smoother collaboration between sales and finance teams leading to shorter payment cycles and more cash flow for your business.

Accurate cash flow management

When you do Pipedrive Quickbooks integration, it ensures that financial data is up-to-date and accurate. Hence, it generates comprehensive financial reports, giving businesses valuable insights into their sales and financial performances. They can make critical data-driven decisions on that accurate financial information, which is especially important for small businesses.

Customer Satisfaction Multi-fold

When your customers have queries without integration, your customer support representatives don’t have all the necessary information, and sometimes they have to request information from other departments, leading to customer dissatisfaction. To respond to customer inquiries, your customer support representatives require a considerable amount of time, resulting in a negative customer experience and potentially losing customers. But after integration, you have all the data in your hands, hence This real-time knowledge helps in having more informed calls, higher conversions, and creating a loyal customer base for your company.

Reduced costs and increased productivity and profitability

As QuickBooks Pipedrive integration eliminates manual data entry and avoids duplication of work and double data entry leading to reducing the risk of errors. Hence, Employees can work on more productive tasks such as following up with leads and closing deals. Better collaboration across departments and a connected workforce mean more productivity and a reduction in costs, leading to higher profits, implying the whole team can work inclusively to achieve more.

Better Forecasts, Predictions, and Business Intelligence

With Pipedrive integration with Quickbooks, real-time data, and access to the collection of recent year-on-year financial transactions, you can create better financial plans for the future. It leads to accurate reporting of your business based on set key performance indicators (KPI) which allow you to make informed decisions on demand and supply.

Lower training costs

As both departments need to know about integration, you can train both department’s employees simultaneously, leading to less IT overhead. On the other hand, this will also increase their understanding of core business goals and learn how to take important actions that might affect other departments, hence reducing the cost overall.

How to integrate Pipeline and Quickbooks

Yeah. You are right, there are two ways to integrate Pipeline with Quickbooks. But if you want more control, or you have a different need, then people use third-party apps in between Pipeline and Quickbooks, But I will explain about it how to do it both ways down below.

Through Third party app

There are so many third-party integration tools available for Pipedrive QuickBooks integration like PieSync, Zapier, Automate.io, and Commercient SYNC. All tools have their strength and weakness, so choose a tool that meets your business need and budget. I am providing you with the process in steps that will make it easier to understand.

Step 1:

After deciding the tool that suits your need and budget, You have to create an account with that tool. Most of the tools offer a free trial, so you first try their tools then if it’s to your liking then commit to a paid plan.

Step 2:

After step 1, you need to connect both to the integration tool, so provide login credentials for Pipedrive and QuickBooks.

Step 3:

You need to Set up the Integration. As the setup is different for every integration tool, they have one thing in common. You have to map the fields of Pipedrive to the fields in Quickbooks, meaning you can decide which data you want to transfer from Pipedrive to Quickbooks.

Step 4:

Test and Monitor the Integration. As for testing, create a test deal in Pipedrive and check whether the data is transferred to QuickBooks or not. You can monitor it regularly, if you face any issues contact customer support.

Through the Pipedrive integration section

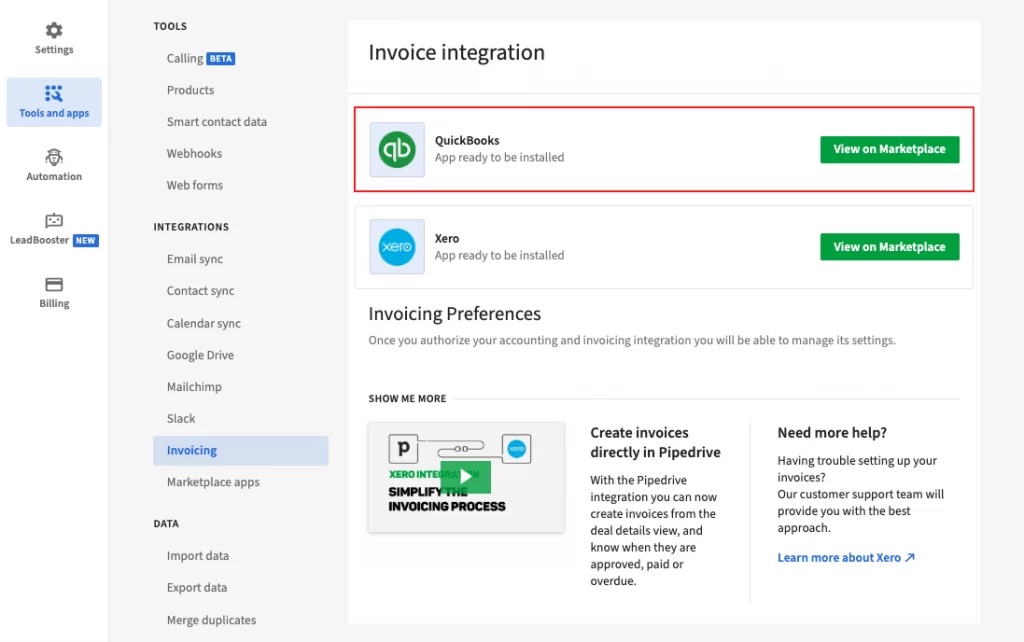

Okay, so let’s start with the process of Pipedrive QuickBooks online integration. If you are familiar with Pipedrive there is a tab on the left and one option is tools and apps.it is a marketplace that has so many apps for integration we use this tab in the following steps.

But before that, I am assuming that you have login credentials in both Pipedrive and QuickBooks. Now, one thing to note is that Only one user per Pipedrive company account can have an active Quickbooks integration at a time.

So I am writing the steps to take Pipedrive integration with Quickbooks:

Step 1:

Log into your Pipedrive account.

Step 2:

Go to Tools and Apps in the left tab, Under that Click Invoicing option and select “Quickbooks”. Then You will be taken to the marketplace, where you can complete the installation process according to the instruction flow shown on the screen and grant the app access to your account.

Step 3:

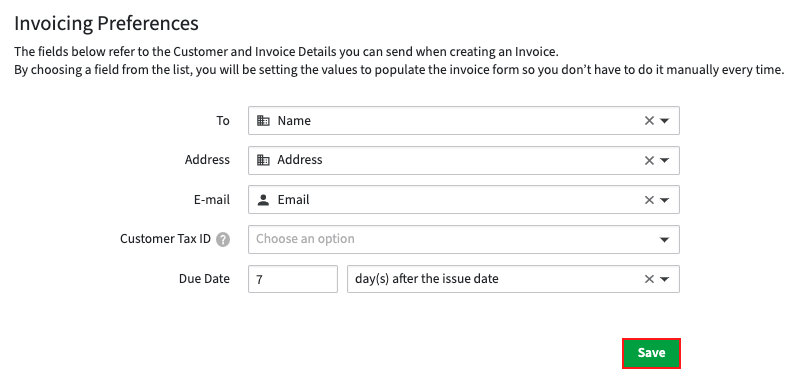

Now after step 2 when your valid Quickbooks login credentials have been confirmed by showing the confirmation on your screen, you will be directed back to your Pipedrive settings. Here you have to configure your Quickbooks integration preferences where you have to fill the value to the 5 fields.

Now as you can see in the above image to set up the Pipedrive Quickbooks integration. You will have to fill in the respective suitable Pipedrive fields and then only the due date will be auto populated when you create an invoice after the integration. There are total 5 fields, I will explain them one by one.

To—

This is the field to whom you wish to address the invoice.

Address —

This field is for the physical address to whom you wish to address the invoice.

Email—

This field is for the Email to whom you wish to address the invoice. In most cases a company’s accounts payable division often pays bills, so we advise using Pipedrive’s organization – Name, Address field, Email, in the above three fields respectively, but you can also choose Other organizations, individual contacts, and deal fields.

Customer tax ID-

Now for this field, as in most cases the invoices don’t require this information. But if you had created a custom field in Pipedrive for storing your customer’s tax ID information, then you have to fill that in here.

Due date—

Here you can set up the due date of the payment. By the way, if the due date is set for 7 days after the issue date, then an invoice created on Aug 4th will have a due date of Aug 11th.

You can save your integration preferences for your company’s Pipedrive account by clicking the “Save” button once you are pleased with your selections for the Pipedrive fields to populate your Quickbooks invoices.

Conclusion

As we write this blog in this manner so that even a beginner who doesn’t know about Pipedrive and Quickbooks can understand and able to do Quickbooks online Pipedrive integration. Although both Pipedrive and Quickbooks are great tools in their respective field in the marketplace, and they still provide updates, connecting the two creates a perfect combination of their own Customer relationship management tools and accounting or bookkeeping.

Before this, a sales team streamlined these processes, but even though there is a chance of errors and mishaps always existed. After this integration, the business can save both money and time, hence increasing productivity and profitability. As you can read, you understand how easy for businesses nowadays to integrate these tools and make your business grow like never before.