Need help to print W-2 and W-3 in QuickBooks Desktop so that you can prepare tax returns easily? If the answer is ‘Yes’, then this blog will be beneficial for you. Yes, here in today’s blog you will know that, ‘How to print W-2 and W-3 form in QuickBooks Desktop.

Obviously you must know that how important are the W-2 form and W-3 form in accounting during the tax preparation. So let’s start reading this blog, without wasting any time. But before printing the W-2 and W-3 forms in QuickBooks Desktop we have kept some important points in our mind.

Important points need to know before printing the w-2 form & w-3 form in QuickBooks Desktop

- QuickBooks Desktop has a limitation to print payroll form in QuickBooks Desktop.

- Its maximum printing capacity is up to $9,999,999.99 for all box form type.

- QuickBooks Desktop process W-3 form automatically during the printing procedure of w-2 form as a summary of W-2s.

- if in case, it exceeds the limit, then there will be an error appear in QuickBooks Desktop.

Requirements Need to Print W2 & W3 form in QuickBooks:

The below given list are the requirements, by which you can print the W-2 form and W-3 form in QuickBooks Desktop. Have a look, and arrange all the requirements to print the W-2 & 3 forms in QuickBooks Desktop.

- In the QuickBooks Desktop, we start to print with the W2 form, take black ink, and print on a paper. And, make sure it will work with QuickBooks Payroll version.

- In this, you have to ensure that you are using a supported QB Desktop version.

- And, should have a proper working QuickBooks Payroll Standard or its new service.

- For the payroll service, you should have W2 papers and a printer.

- And you should use blank papers or preprinted paper of laser printer.

- Then, give for the inkjet printer, and use preprinted forms.

- Also, have the current payroll tax table.

Steps to Print W-2 and W-3 in QuickBooks Desktop:

The process will be done by following three steps. The 3 steps are given in the below, just read and follow the steps carefully:

1. Find Out the W-2 and W-3 forms From QuickBooks Desktop:

- Firstly, press on the employees’ button then, payroll tax forms and W2s. and, click on the process of Payroll forms.

- Then, select the given option of annual W-2 and W-3 forms and tax statement transmittal. Then, tap on Create option.

- If in case, you have to file the forms of all the employees then, choose all the employees.

- When you are printing, add that year in the form. Then, press on OK. QB Desktop only manages one version of the tax form. And, you need to use the updated version of the form, when you want to print W2 forms of the previous year. And, you already have the newer version.

- For printing the form, choose the employees. If you want to recheck or edit the form, click on the edit option. Then, click on the submit form to move ahead. To print the form, choose the employees.

- Then, press on the Print or e-file.

2. Choose the Paper Type and Item to Print the forms Window:

- Initially, choose either blank paper and preprinted forms.

- Select the employee of whom you are printing the print section under the selected item.

For employees

- In the case of Blank paper:

- 3/page – copies B, 2, C

- For 4/page – copies B, 2, 2, C

- The instruction for employees is necessary if it is not printed on paper.

- In the case of pre-printed forms

- For employee’s federal tax return for 2/page – W2, Copy B

- Your state or Local Tax Department for 2/page – Copy 2 of W-2

- The employees’ records for 2/page – W2, Copy C

- The instructions are required for filling the form, if not printed on paper.

For Employer

- For the records 2/page – W2, Copy B

- And, the instructions for filling employer form – W2 and W3 forms

For Government

- W3/page

- W2/Copy A – for the SSA, 2/page

- W2/Copy 1 – the local tax department, 2/page

3. Convert the Form to PDF Reader & Start Printing

- Firstly, do a print test, if you are using the preprinted forms.

- Then, click on the print PDF which you can print.

- Then, begin the printing process start.

Other Recommended Articles:

QuickBooks Online System Requirements for 2022

How to Write Off Bad Debt In QuickBooks Online & Desktop in 2022

QuickBooks ProAdvisor Certification Exam Questions 2022 PDF Sample: Be a Certified Expert

How to Archive, Save, & Email Adobe Reader of W-2 form in QuickBooks Desktop

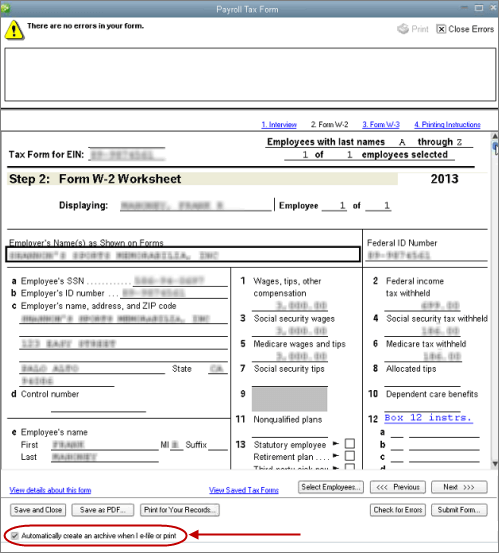

To Archive W-2 form in QuickBooks desktop:

- Go to the Payroll Tax Center.

- Mark the ‘Automatically create….or print’ box.

To view the e-file archived W-2 form:

- Go for the Employees tab and select the Payroll Tax Forms and W-2s.

- Then click on the ‘Process Payroll forms’ option.

- Now you can see a printed file listed in the ‘Filling History’ section or in the ‘Saved Fillings Tab’.

- From the Saved PDF column, click on the link to open.

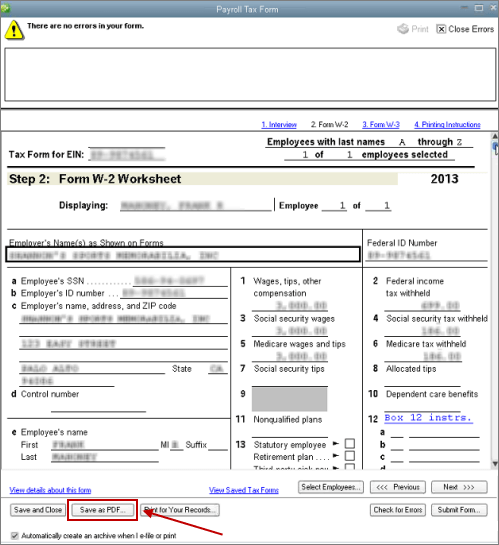

To save a draft of the W-2 form(s):

- First visit for the Payroll Tax form, and click on the ‘Save As PDF’ option.

- Then select that location where the W2s form saved in draft.

- And ‘Save’ it.

To email the W-2 from Adobe Reader:

- Go for the ‘File’ menu and click on the ‘Send’ option.

- Then click on the ‘Page by Image’ option or you can save it as an attachment.

Conclusion

So here was the blog, which described the printing procedure of W-2 and W-3 form in QuickBooks Desktop. We tried our best to put information in this blog, hope you like it. Still, if you have any kind of doubts or problems regarding this blog, then you can get our ProAdvisor support through the toll-free number +1-855-525-4247.