Searching for the best accounting software for lawyers? Well, if you work as a lawyer in a law firm, QuickBooks can help you ease your accounting. It manages your practice with comfort and simplifies your legal billing to save time and focus on casework. So, read this blog carefully to find out how you can take your legal firm to next level with QuickBooks.

QuickBooks is one of the popular software and equipped with a wide range of accounting features and available in different-different plans for mobile, desktop, and tablets with secure bank integration. If you want to manage all clients in one place then you can download and install it in your system or devices. You can easily bill your clients, manage costs in the office, and track time efficiently.

What Can You Do with QuickBooks as a Lawyer

Here are some of the advantages listed which lawyers can avail themselves by using QuickBooks for accounting in their law firm.

- Easily Automate Accounting Tasks: You can securely connect QuickBooks with your bank to eliminate data entry and keep your books updated. Not only that, but also you can record payments from clients, tag expenses to specific cases, and etc.

- Manage Billing: It makes it easy to manage bills for you. You can easily create custom rates for partners, assistants, and associates. Set hourly billing rates instantly for each legal service. You can do the exact match during the addition of billable hours to invoices.

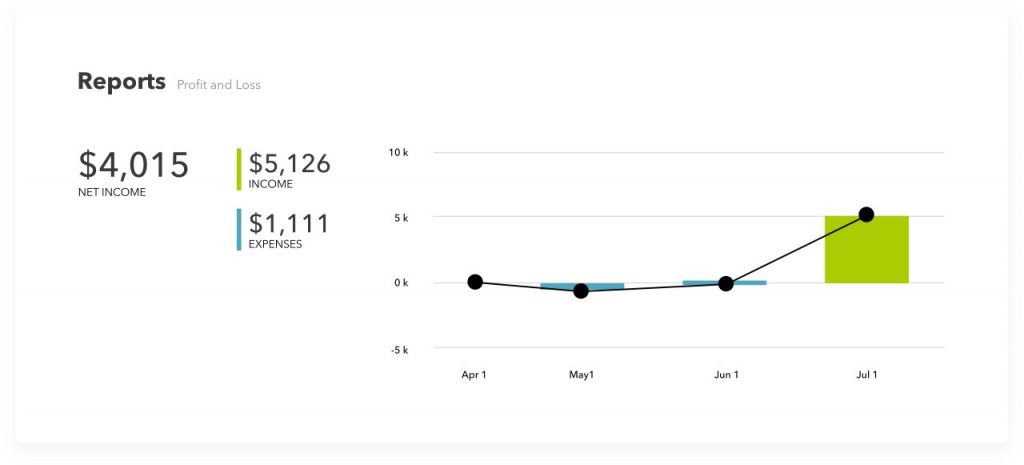

- Run Reports at Every Moment: Get instant reports and find out exactly where you stand. QuickBooks helps in tracking each and every dollar for your clients and cases. It schedules reports for sending you and your clients.

- Track Time: You can easily track hours by case, client, or activities and other staff members can also record time on their mobile phones.

- Create Invoice: You can also create recurring invoices and schedule invoices to email them on the required dates. QuickBooks also allows you to customize and create your invoices templates representing your law firms.

- Easy Payments: You get paid faster as it accepts all bank transfers and credit cards directly into invoices. It automatically matches payments to invoices and sends payment reminders.

- Get Financial Statements: Generate your cash flow, profit and loss and balance sheet at a flow and instantly send their reports.

- Access from Anywhere: You can access your financial reports from anywhere from your computer, phone, or tablet. Get the full details of your business activities, no matter where you go.

- Track Retainers: You can track your money which is held with trust retainers as well as general retainers. It makes it easy to manage your retainers bound to the state’s specific rules.

After finding out in what ways QuickBooks helps your law firm, now learn to set up a chart of accounts in QuickBooks.

Other Recommended Articles:

How to Make an Employee Tax Exempt in QuickBooks Online

QuickBooks Won’t Download Bank Transactions: What To Do to Fix the Bank Error

Fix QuickBooks Connection Has Been Lost Issue to Access Company File

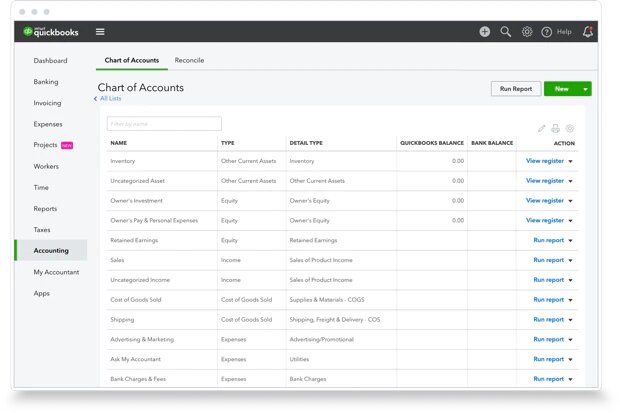

How to Set Up of Chart of Accounts for QuickBooks Law Firm

For setting up a chart of accounts for QuickBooks law firms you have to follow the below steps:

- At first, you need to create a bank account ‘Client Trust Fund Checking‘. By creating this separate bank account, you can track all the deposits and payments from the trust fund of your clients.

- Now you should check with your banker to confirm that the account has an automatic overdraft or need ATM access.

- After that, rename your accounts payable – operating and this payable account use for payment and billing of your law firms day to day operation.

- In the next step, set up another payable account. This account is called ‘Account Payable’ used to track bills and payments related to your client.

- Now set up another liability. This liability is called ‘Client Trust Liability’ used to track all deposits from your clients and other costs.

Besides this, you can also connect to various apps that work awesomely for law firms and attorneys. You can also assign different billing rates for partners, associates, paralegals, and more.

Syncing with Third-Party App for Law Firms and Attorneys

Integrate with third-party apps such as Clio, Time Tracker + Legal, and LeanLaw to enjoy advanced key benefits.

- Clio: It is an amazing app for all lawyers and attorneys because of its features. You can manage cases, automate documents, get paid faster, run reports, generate bills, automate documents, attract potential clients, and etc. All these tasks become easy with QuickBooks.

- Time Tracker + Legal: It offers robust timekeeping with some legal features (ABA codes, invoicing, conflict checker, and etc). Not only that, but also you can approve the timesheets, can sync with QuickBooks to perform the billing and payroll.

- LeanLaw: LeanLaw is a legal billing software for mid-sized law firms, and it is also a top-rated legal app for QuickBooks Online. You can get the advantage like timekeeping, billing, managing expenses, fixed fee billing, reporting, onboarding, ledes billing, and etc.

Therefore, use QuickBooks accounting software for your legal firm to streamline your workflow and increase productivity by monitoring your business. It is the most advanced tool to protect the privacy of your case and sensitive information. To meet your legal office need, download and install QuickBooks. Call our QuickBooks ProAdvisor at +1-855-525-4247 for any queries.