When you want to grow up your business by the end of the calendar year. You have to prepare your file with 1099 forms. By using 1099s in QuickBooks, you can simply start the wizard at vendors. Here, We will discuss how you can prepare the form in QuickBooks 1099 Wizard.

When you paid totally to your contractors in the last year. Using QuickBooks, the 1099 Wizard will help you to secure your time and easily store your file with 1099-MISC forms. After using Wizard, you feel that you will be proficient to prepare, review and prepare the sequenced file to all the essential copies of your 1099-MISC forms with the IRS in simple steps.

Benefits of 1099 Wizard for Clients or Contractors

- Firstly, the short term employer of the subcontractor will easily find 1099s a simple form of a file. Where you pay contractors via 1099, clients do not have any income taxes withhold.

- No need to maintain any sort of continuing relationship with the contractor.

- working with 1099 is the very easiest way to pay your contractor for the one time task.

- Contractors receive or gain more money with employees pay via W-2s, which is with withhold taxes.

- Contractors can receive 1099s and can also claim the itemized deductions.

Other Recommended Articles:

How to Set Up QuickBooks Online Bank Rules

How to Enter and Pay Bills in QuickBooks Online

How to Reconcile Workflow in QuickBooks Online

How to access the Wizard

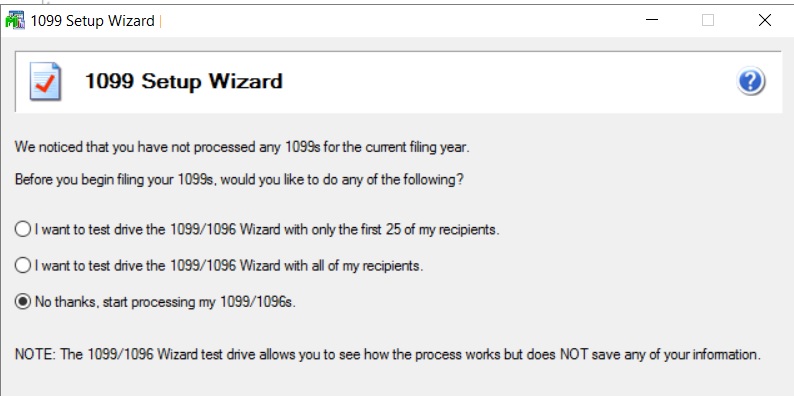

There are some simple steps that help you to access the 1099 wizard. these are-

- Go to the Vendor part and select print or efile 1099s.

- After that Select the 1099 Wizard and Get started to proceed through the wizard.

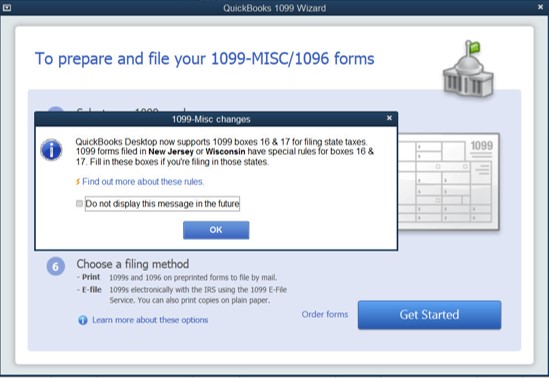

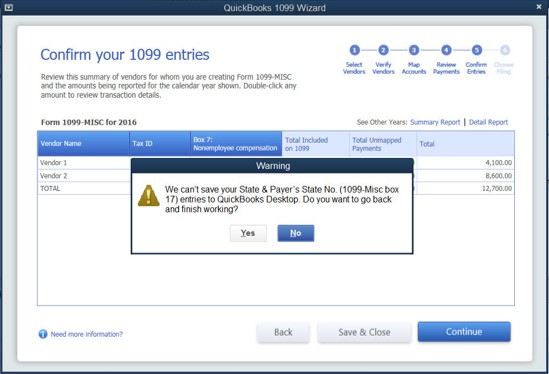

When you prepare the file for New Jersey or Wisconsin, You get the pop-up message like in the below image-

How you can easily prepare the form in QuickBooks 1099 Wizard

There are some basic steps to prepare the form in Quickbooks Wizard, We are going to discuss these steps below-

- SELECT 1099 VENDORS

- VERIFY VENDORS

- MAP ACCOUNTS

- REVIEW PAYMENTS

- CONFIRM ENTRIES

- CHOOSE FILING

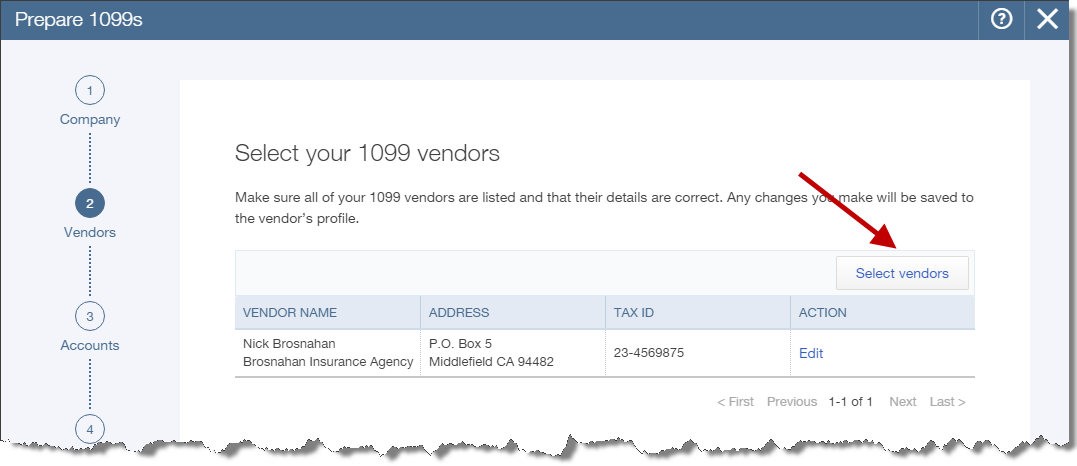

Select 1099 Vendors-

Open the list that is taken from the vendor list. Choose the vendors who need Form 1099-MISC, After that Click to Continue.

Note: You can also Change the Selections and change the vendor’s status also in your company file.

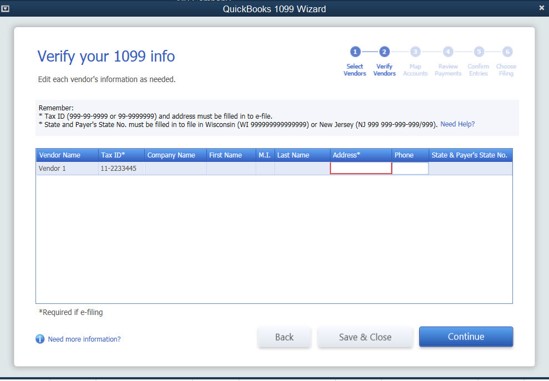

Verify Vendors-

The below image describes to you that the cell values can be edited by the click double on the cell within the table. for proceeding click to continue.

There is a new feature added in 1099 wizard, It can be Set a reminder for your important fields.

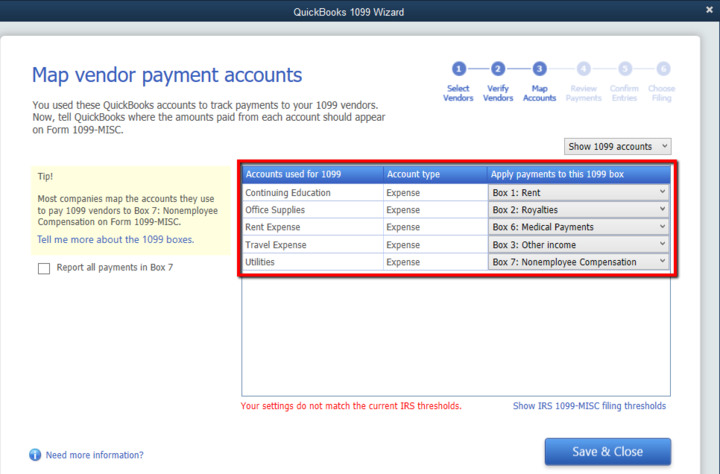

Map Accounts

Map Accounts

If the amount is mapped into boxes then amounts will be included for reporting.

- For the map accounts from 1099 forms, Select from the Apply payments to 1099 box from the dropdown list.

- If it is applicable, Select the report all payments in Box 7 Checkbox.

- Click Continue to proceed.

In the above picture, you see that the red-colored message. If this type of message occurs then you have followed these steps-

- Select the hyperlink Show IRS 1099-MISC filing thresholds.

- After that click to reset IRS Thresholds Button.

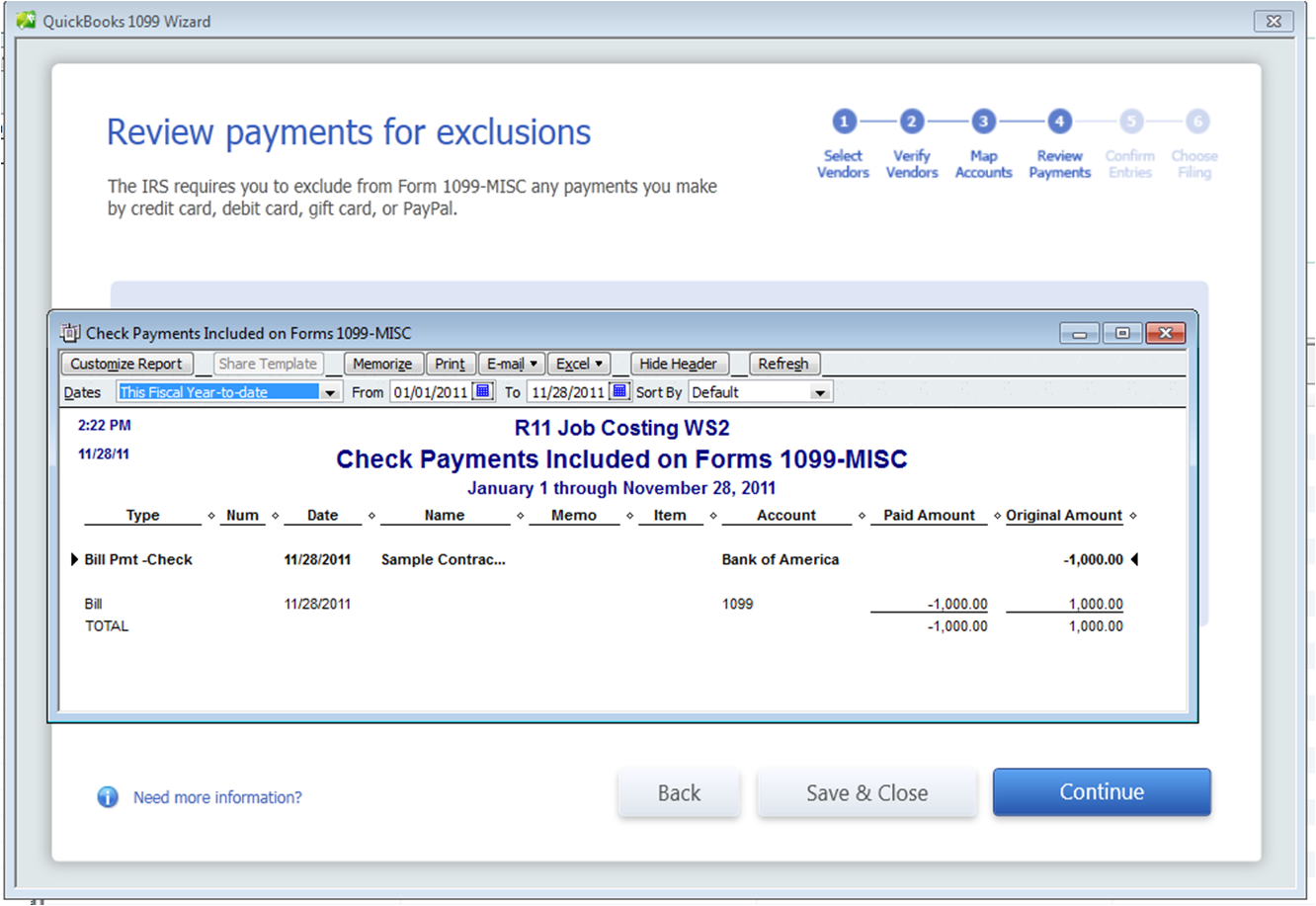

Review Payments

The Internal Revenue Services is required to exclude the electronic payments from being reported on 1099 MISC. and this process includes credit cards, debit cards, gift cards, or PayPal payments also.

You have to note the payment method in the check number field when you use check payments to record a vendor payment made with a credit card, debit card, or gift card.

For Check any payment containing one of the following notation in check number list :

- DebitDebitcarDBTDBT cardDCardDebit

- cdVisaMastercMCMCardChaseDiscoverDinersPayPal

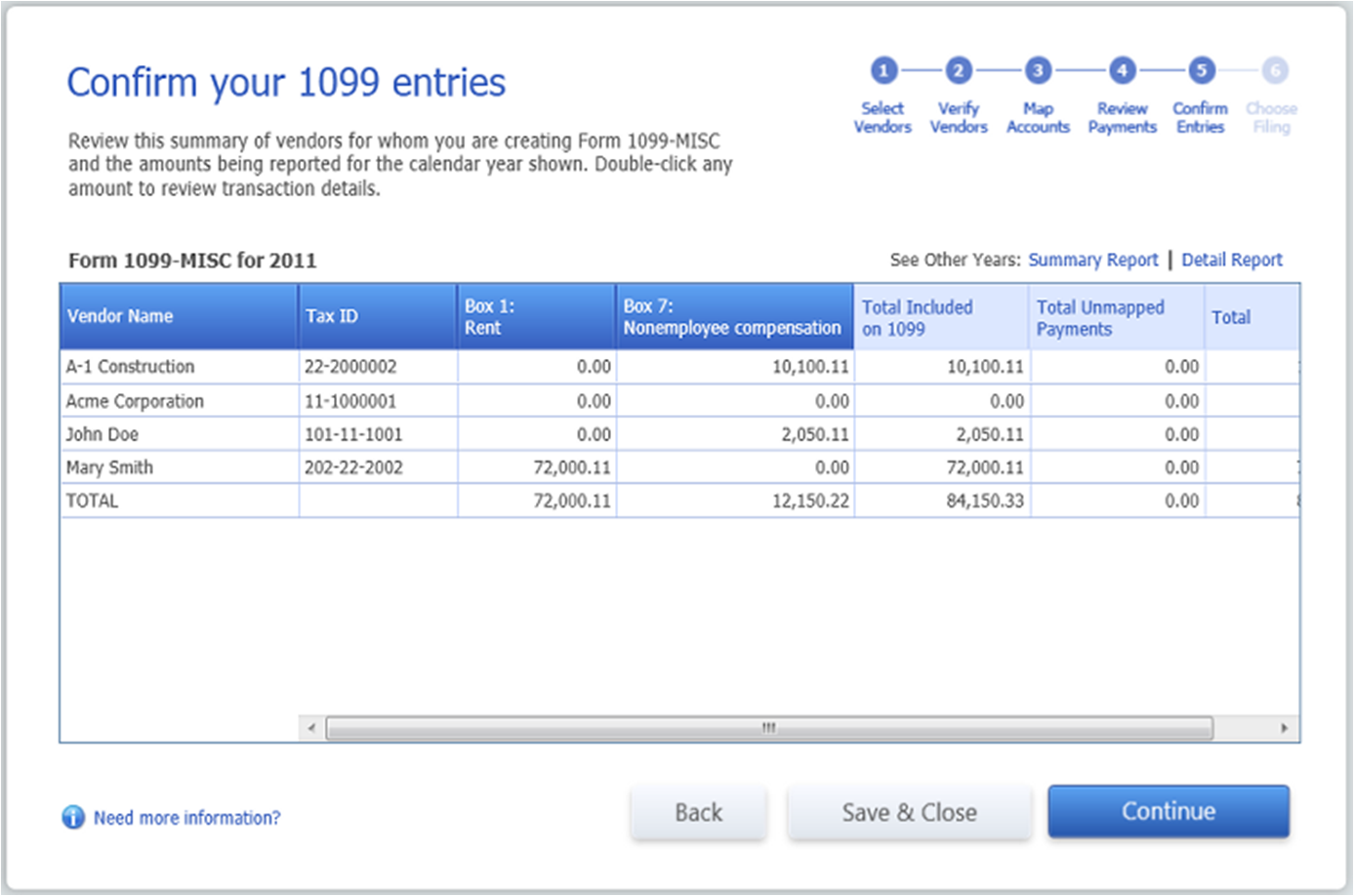

Confirm Entries

You can easily review the summary of vendors and the amount which will be reported. It also displays those vendors that are the thresholds. and These vendors will not get a Form 1099-MISC.

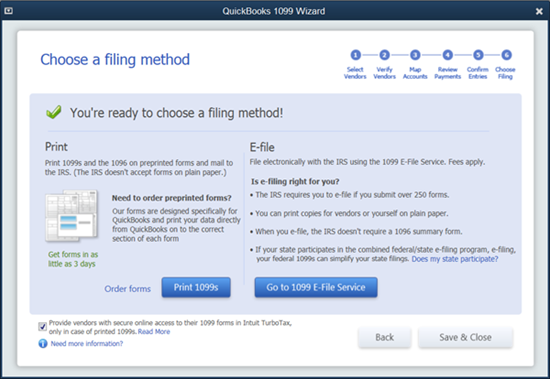

Choose the filing method-

After finishing all the above steps, the last step is to choose the method to fill. And there is a pop-up message window open for E-file. Select one of these, Click Save & close.

How you can search the missing vendors from the QB 1099 Wizard

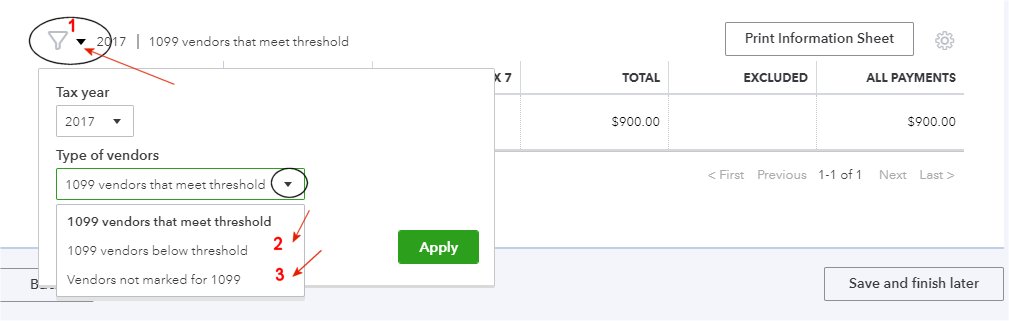

When you want to find the vendors list who is missing in your list. At that time you can use the search filter for searching and find out them.

In the below image you can see that how you can find the missing vendor easily.

- Click Save & Finish Button.

QuickBooks 1099 Wizard is good for desktop reports. The QuickBooks Desktop 1099 report gives you an option of displaying all accounts, not only 1099 mapped accounts.