Whenever a new employee is added to the company for a proper employee report, QuickBooks Online payroll needs to provide the employees’ hire date and set up the QuickBooks employee hire date report. This is the most professional way to hire an employee and to add it to the employee report. So, here we have the article to discuss the employee hire date and the setup process. Keep in touch with us till the end of the article for detailed information.

Why Does QuickBooks Need the Employee Hire Date

Most of the QuickBooks users have the question that, why does QuickBooks need the employee hire date. Here we have the complete answer to the question.

The Employee hire date makes it easy to, create a proper report of new hire forms, and to set up the vacation or sick pay policy.

Other Recommended Articles:

How to Set Up a Loan in QuickBooks Online

How to Add Service Fees to Invoice in QuickBooks Online

How to Delete Data and Starting Over in QuickBooks Online

How to Create a New QuickBooks Employee Hire Date Report

An employee hire date report in QuickBooks can be easily created in payroll. Here, we have the full guidance to create the report, just go through it, and complete it in just 2 steps.

Step 1: Arrange the Necessary Information for the Hire Date Report

In the first step, we will arrange all the information to create the hire date report. There are three things, which are very important to keep, and they are gender, birth date, and hire date.

- Gender is not necessary for the hire form, but some of the states need gender on the hire forms.

- Birthdate is the most important need for the new hire form. Not only that, but also it needed for the employees enrolled in 401 (k) plan to calculate the maximum contribution, and to determine the catch-up amounts.

- The first day of pay is always required by all states in US, except Colorado. So it will be good to add the employee’s first payday as the hire date.

Step 2: Create New Hire Date Report in your Payroll Service

Go for the procedure, according to your payroll service to create a new hire date report.

To Create a Hire Date in QuickBooks Online Payroll Enhanced

Here is the step to create a hire date for those who are using QuickBooks Online Payroll Enhanced:

- Go to the ‘Payroll’ section of QuickBooks, and click on the ‘Employees’ option.

- Now choose the Employees’ name, and click on the ‘Edit’ icon, which is next to employment.

- Now check that the ‘Have you filed a new-hire report with the state? the box is marked or not, if the box is marked then unmark it, and click the ‘Done’ option.

- Select the ‘Payroll Tax’ option from the ‘taxes’ section, and the ‘Employees Setup’ option from the ‘Forms’ section.

- At last, click the ‘New Hire Form’ option.

To Create a Hire Date in QuickBooks Online Payroll

If you are a QuickBooks Online Payroll user then, follow the procedure:

- Visit the ‘Reports’ menu, and in the search field, enter the ‘Employee detail’ option.

- If you need to filter anything then, you can filter the report through the employee, and its work location.

- Select the ‘Run Report’ option, and go to the ‘Share’ dropdown to choose the ‘Export To Excel’ option.

- If you want to print it then, you can select the ‘Printer Friendly’ version option.

To Create a Hire Date in Intuit Online Payroll Enhanced

Those who are using Intuit Online Payroll Enhanced can follow the given procedure to create a new hire date and set up it in a proper way.

- Select the new Employee’s name from the ‘Employees’ section, and go to the ‘Employment’ section to select the ‘Edit’ option.

- Unmark the filed, and click the ‘Ok’ option.

- Then, go to the ‘Taxes & Forms’ section, and select the ‘Employee & Contractor Setup’ option.

- Lastly, click on the ‘New Hire Form’ option.

To Create a Hire Date in Intuit Online Payroll Full Service

Follow the procedure to create a new hire date for Intuit Online Payroll Full service:

- Select the ‘Employee Details’ option from the ‘Reports’ menu.

- And filter your employees’ work location and workers’ comp class.

- Click on the ‘Run Report’ option.

- Now you can select any one of the options for the report, either the ‘Printer-Friendly version’ or the ‘Export to Excel’ option.

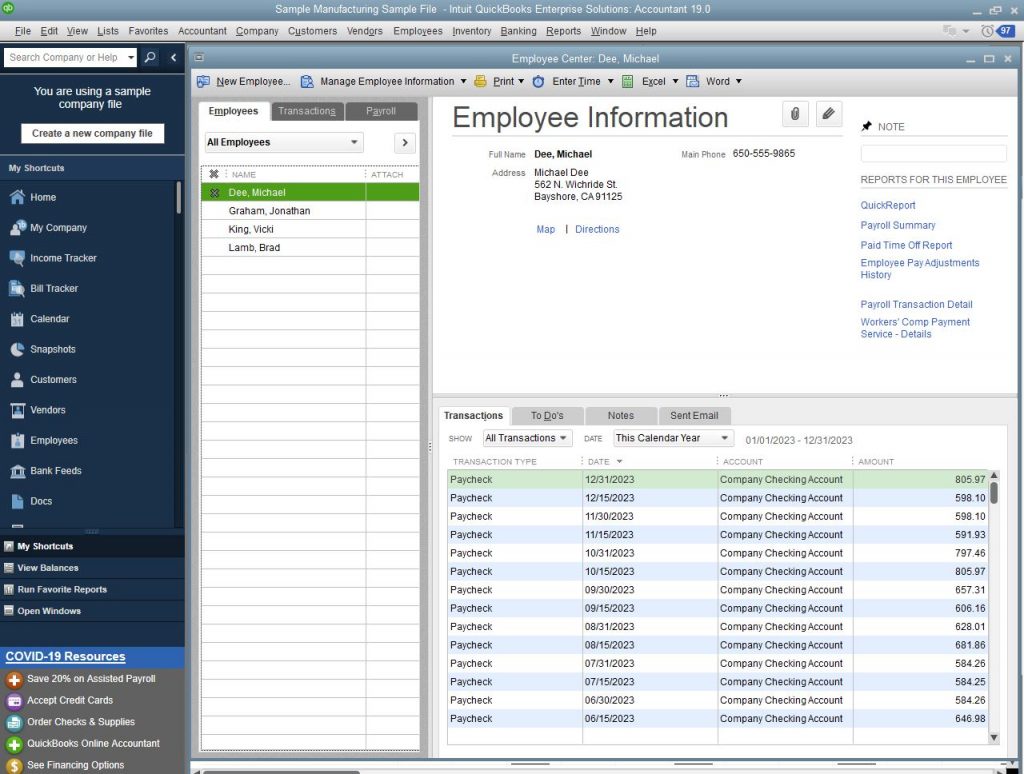

To Create a Hire Date in QuickBooks Desktop Payroll Enhanced and Assisted Payroll

If you are a QuickBooks Desktop payroll Enhanced and Assisted Payroll user then, you can follow the below-given procedure:

- Select the ‘Payroll Center’ from the ‘Employees’ section.

- Then, select the ‘File Forms’ tab, and go to the ‘File Forms’ section.

- Now from that section, click on the ‘New Hire Form’ option.

- If in case, the form is not available then you can go for the below-given procedure.

- Go to the ‘Forms’ dropdown to select the ‘Make a New Form Active’ option.

- Choose your state, and form then click on the ‘Add Form’ option.

- In the next step, you can choose the ‘File Form’ option or the ‘Create Form’ option.

- Now, follow the onscreen instructions from the ‘Select payroll Form’ window to complete the form.

The End Line

So this was the article, to create and set up QuickBooks employee hire date report. We hope you are able to create a new hire date report and have the idea of hire date importance. Still, if you have any kind of issues regarding this topic then we will recommend you to find a QuickBooks ProAdvisor for the best answer.