In the healthcare industry, many professionals face challenges in their day to day basis accounting and bookkeeping services. And they don’t have the idea that ‘How to manage all these things?’ If you are also part of these challenges or want to get rid of this problem here we have an article for you ‘QuickBooks for healthcare professionals and medical practice’, that will fix your problem easily.

QuickBooks for Healthcare Professionals: A Little Overview

QuickBooks is the best accounting software that helps healthcare professionals to track accounting profitability, not only that but also it can lead to small business success & manage their accountants, bookkeeping, and complete some human resources responsibilities. It helps healthcare professionals in many ways like medical office manage bills, records, payment, track bill status, create a check for vendor/employee, and many.

In the USA many healthcare professionals work with QuickBooks software. this software is available for many types of healthcare professionals areas such as:

- Physical therapists, mental healthcare

- Doctor, dental or oral

- Podiatrists, optometrists

- Home health care

- Medical practices

- Medical group

QuickBooks provides accounting, tax, payroll services to the healthcare practitioner. you can manage easily healthcare reforms, increasing costs, healthcare types services, and financial reports to a well-run business and long-term prosperity.

Advantages of QuickBooks for Healthcare Professionals

Intuit provides many services with QuickBooks for healthcare professionals including accounting, cash flow analysis, bookkeeping, and many services such as given below:

- Cash flow management

- Financial reports and statement

- Budget and finance project

- Accounting & Bookkeeping

- Create GST invoice and report

- Sales orders and invoices

- Tax planning

By using QuickBooks for healthcare professionals, USA healthcare professional makes better decisions of business performance with business account data into dynamic & smart reports and presentations. And support in many businesses aspects like:

- Create invoices faster, QuickBooks invoice feature saves your time and money.

- Track finance and business detail with many feature like improve searching, filtering, sorting tracking information as you want efficiently.

- Secure and manage your business-sensitive data put into the right hands.

- you will get many ideas for growing your business with complex workflow

While working with QuickBooks you will work without any interruption and access your QuickBooks account work on your phone anywhere. Then you will find yourself more confident in expanding and growing your business.

If you want to start your business, QuickBooks software is best for your healthcare practice and small business.

You can do medical practice anywhere, anytime. It makes practice easy to understands and you don’t need to do struggle to manage finances with QuickBooks software.

Use QuickBooks For Medical Practice

How do healthcare professionals use QuickBooks for medical practices to set up banks and credit cards? QuickBooks provides the best way to manage the transaction of your bank and credit accounts.

- Reconcile your bank & credit account:- In QuickBooks software, you can easily reconcile your bank and credit card on a monthly basis or a daily basis and this feature help you to correct a common error like forgotten charges, postage charges, etc.

- Tracking and reporting management:- QuickBooks helps to track and report your account data on a regular basis and performance indicates your account outstanding, total margin, expenses, and many financial reports. this feature helps to grow & thrive in your practice.

- Track performance by using classes and location:- This feature helps you to manage cost and save time. you can track your performance of many services lines.

- Create a standard chart of account:- By using the standard chart of account, you can represent the specific need for medical practice.

Benefits of QuickBooks for Medical Practice

Now let’s know what are the benefits of using QuickBooks for healthcare professionals or for medical practice, you can get benefits based on healthcare

- Medical projects and information

- Manage the monthly account dashboard to know about performance for your medical practice

- Determine profitability to track the performance of costs for classes & location for medical practice

- Medical tax planning

- Many resources available to practitioners

- Manage and organize finances

- QuickBooks for healthcare professionals make better-informed decisions

Setting Up QuickBooks for Medical Practice

- First, you need to Sign up for a free trial

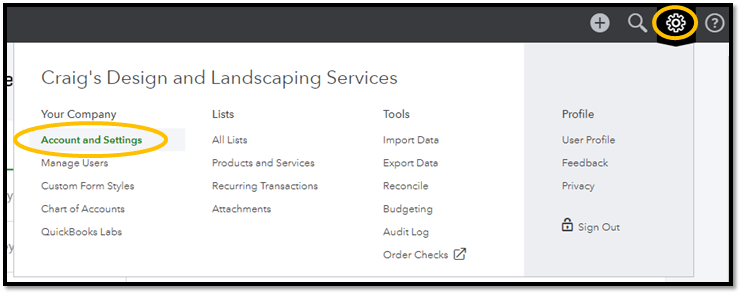

- After it, open click on the “+” gear icon

- Then, click on Account and Setting in your company column.

- Fill all information on the screen fields such as company name, company type, and information about medical data

- Setting up a financial statement chart of account

QuickBooks provides you with real-time online access & collaboration for accounting. You can easily connect your bank account & credit card account to QuickBooks. Customize QuickBooks online software with your company/medical information and operate a new version of QuickBooks online. Let’s see the use of QuickBooks Online.

Using of QuickBooks Online for Medical Practice

If you want to manage your finance in a better way by using QuickBooks then the following tips help to manage and organized your finance.

- Maintain your separated account for the business without combining funds by using QuickBooks online for medical practice.

For example:- For the medical practice, you can maintain a separate credit card account. You should reconcile credit card entries monthly.

- Maintain records regularly- you can maintain records and update records regularly for your organized business.

- You have to choose the QuickBooks version for leading accounting for your business. intuit provide many version of QuickBooks with best features. like -QuickBooks payroll, premier, etc.

- You can easily access online medical practices.

- Access QuickBooks on your mobile anytime anywhere.

- Create a customized chart is best for medical practice and finance.

- QuickBooks helps you to judge your practices and ensure that accurate accounting finance practices.

By using QuickBooks as a healthcare administrator, medical practicer, medical office administrators can keep practice running and making a profit. Become the best healthcare professionals for your business thrives.

Other Recommended Articles:

Which QuickBooks Version is Right for Small Business

QuickBooks Desktop Enterprise 2022: What’s New in It

QuickBooks Desktop 2022: New Changes in Features, Plans & Pricing

Tips to use the QuickBooks Software for Medical or Healthcare Purpose

In the above, you get the information that ‘How to use QuickBooks as a healthcare professional or for the medical practice?’. Now here you will get some tips to use QuickBooks for healthcare professionals or for medical practice.

- Use Separate Accounts

- The very first thing is, you have to use separate accounts.

- Choose an Appropriate QuickBooks Version

- Keep Receipts

- Customized Chart Of Accounts

Conclusion

We hope this article will help you a lot, especially for those who are wandering for the QuickBooks for healthcare professionals & medical practice. We tried our best to collect information regarding this topic as much as possible and to put the information in this article in the right way. Further, if you have any kind of doubts regarding this article then, you can get Accountwizy ProAdvisor support through the toll-free number +1-855-525-4247.