Excited to utilize the features of QuickBooks Self-Employed but encountered a sign-in error? Don’t worry, we are here to help you. Here you will find QuickBooks Self Employed login procedure and solution to fix the issues. We will also provide the cost and features of QuickBooks Self-Employed, which let you know more about it. Read the article and resolve your query.

QuickBooks designed QuickBooks Self-Employed for sole proprietors, independent contractors, partners of the business, and freelancers. If you are one of them, then it is a better choice for you. It helps you to track mileage, income, expenses, and tax info.

Procedure for logging into QuickBooks Self-Employed

There are two different ways you can sign in to QuickBooks Self-Employed, with the web browser or in the mobile app. The mobile app is free with the subscription, you didn’t need to pay an extra amount. Here’s the process by which you can log in to your system and mobile app.

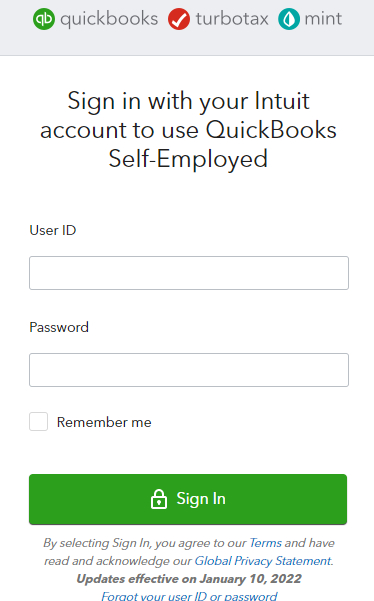

QuickBooks Self-Employed Login in System

These are the steps listed below for logging into QuickBooks Self-Employed account from your system.

- First, ensure that you have the Intuit credential. If you have no account in Intuit then, create an account and come back to the QuickBooks Self-Employed login procedure.

- Click on the link to login into QuickBooks Self-Employed.

- Fill out your user ID, and password in the ‘User ID‘ field, and ‘Password‘ field.

- You can mark on the ‘Remember Me‘ box if you need to access the self-employed for the next time without remembering the ID, and password.

- At last, click on the ‘Sign In‘ option to get into the QuickBooks Self-Employed page.

Steps for Logging into QuickBooks Self-Employed App

We can not take the system, or the laptop anywhere we wish. So QuickBooks designed a Self-Employed mobile app for the user’s convenience. The mobile app gives you additional features like snap, swiping categorization, and store receipt management. You can use the mobile app on both iPhone and Android devices.

Let’s start the steps to download QuickBooks Self-Employed App on both iPhone and Android devices.

- If you use iPhone, open ‘App Store’ or if you use android mobile, open ‘Play store’.

- Search for the ‘QuickBooks Self-Employed App‘ in the search bar.

- After finding the app, download, and install it on your mobile as per the instructions.

- Tap on the app to open it, after the complete installation process.

- Put the user ID, and the password (The ID and password must be the same as the Intuit ID and password.)

- Click on the ‘Sign In‘ option.

- You can sign into it by clicking the ‘Sign In‘ option or through the fingerprint.

Other Recommended Articles:

QuickBooks Script errors : What Is It & How To Remove It?

How to Write And Print Checks in QuickBooks Online

How to recover deleted Quickbooks files?

Fix Login Issues with QuickBooks Self-Employed

Try out these two methods if you are unable to login into your account. Follow each step given below.

Method 1: Log in to Incognito or Private Window

Sometimes browser data fail to log in the QuickBooks. Try to login into the private or Incognito window.

- For Google Chrome, press Ctrl + Shift + N buttons.

- For Firefox, press Ctrl + Shift + P buttons.

- For Safari, press Command + Shift + N buttons.

Login to your QuickBooks Self-Employed account.

Method 2: Clear Cache Data and Cookies

After you log in, clear the cache and cookies to fix the issue by the following process.

For Chrome:

- Open Chrome, click on the three dots located at the top right corner.

- Select More tools and then Clear browsing data.

- Choose the time range from the top.

- Check the boxes next to Cookies and other site data and Cached images and files.

- At last click to Clear data.

For Firefox:

- Open Firebox and click on the three horizontal bars located at the top.

- Click the Privacy and Security panel.

- Under the Cookies and Site Data section, click Clear Data.

- Check both boxes, Cookies and Site Data, and Cached Web Content.

- In the end, hit the Clear button.

For Safari:

- Click the Safari menu, and then Clear History

- Choose All History, in the Clear field.

- Click on the Clear History.

Method 3: Additional Fixation Steps

If the first method didn’t work for you, you can proceed to this method.

- Recheck your user ID and password to ensure that you are entering correctly.

- Make sure to log in to the right login page. Here it is https://selfemployed.intuit.com/login.

- Reboot the system. This will refresh all the background running processes causing the sign-in errors.

- Check your browser privacy setting. Fix it to medium or lower and give access to QuickBooks. Re-open your browser and try to log in to QuickBooks.

- Close the browser and reopen it after configuring the setting. Then, try accessing QuickBooks.

- Use a different browser because every browser uses different cookies.

- If it is still not working, then re-install QuickBooks and log in again.

Method 4: Login Failed After the Password Reset or Shows the Wrong Password

The browser fills up saved passwords automatically from its data. Enter your password manually or clear the cached data. It will remove the old password and you can log in with the new password. After clearing the cached data, close the browser and re-open it.

You can choose an alternate method.

- Reset your password and log in from the new password.

- Click on the My Account after that choose Account Settings.

- Go to the Profile and Verify your user ID.

Method 5: Temporarily Turn Off the Anti-Virus

Sometimes, anti-virus blocks access to login due to strict settings. Temporarily turn off the anti-virus and try to log in again. After logging in, you can turn on the anti-virus program. If the issue still persists you try other methods.

Method 6: Fix Common Sign-in Issues at the User End

Here are some more common issues at the user end faced while signing. Solutions to these problems are discussed below.

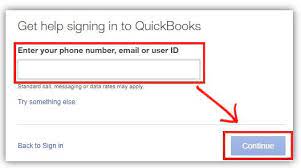

Recover Forget QuickBooks User ID

If you forget your QuickBooks user ID, you are unable to log in. Here are the steps to how you can recover it.

- Go to the Login page and select Forgot my user ID or Password option.

- Enter the phone number registered with your Intuit account.

- Select Continue.

- Follow the instructions displayed on the screen.

- You will get an email from Intuit that contains your user ID.

- Check spam or junk folder if you don’t find the email.

Recover Forgot QuickBooks Password

Many times we forget our password and have to face problems logging in to the account. But you can recover your account with an e-mail id or phone number. Follow the given steps to recover your account.

- Go to the QuickBooks sign-in help page.

- Enter your phone number or email address into the box. Choose to Try something else and answer other questions asked by QuickBooks.

- Click on the Continue button and check your phone or email for the message sent by Intuit or QuickBooks.

- Enter the code received in the message and follow the on-screen instructions. It may ask a few questions to verify it’s really you.

- Once the process is complete, reset your password.

Switch to Another Device

If any of the methods didn’t work for you, move to another device. Maybe there is some issue with your web browser or your system. Sometimes devices follow strict settings and block contact with some websites. It is better to login into another device.

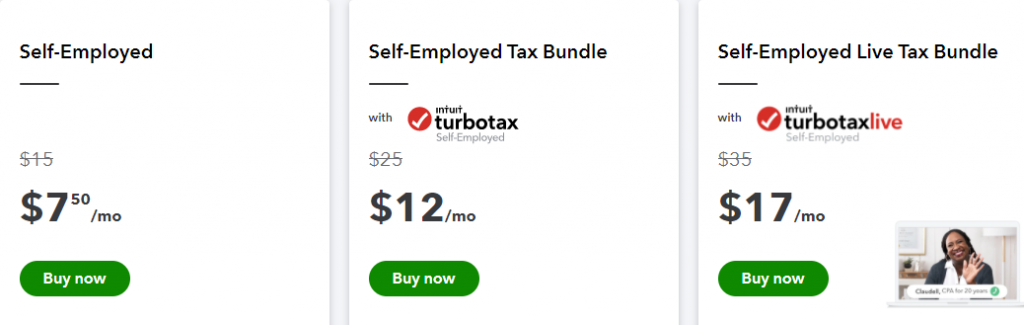

Cost & Features of QuickBooks Self Employed

QuickBooks Self-Employed is available in three versions. You can choose your plan according to your need. QuickBooks Self-Employed app is free with your subscription. Plans available with QuickBooks Self-Employed are:

- Self-Employed- $7.5 per month

- Self-Employed Tax Bundle- $12 per month

- Self-Employed Live Tax Bundle- $17 per month

QuickBooks Self-Employed has lots of features that help to manage business accounting statements. Its features include the following.

- Separate the Business and Personal Transactions: If your personal and business transactions are in the same account, QuickBooks Self-Employed helps you a lot. You can easily separate your personal and business transactions to clear out your incomes and expenses.

- Online banking: Online banking is the most helpful and time-saving feature. After you access your account to the QuickBooks Self-Employed, it automatically downloads the recent transactions. All you need to do is approve the transactions.

- Calculate Estimated federal Quarterly Tax Payments: If you are self-employed, you need to pay federal self-employment taxes quarterly. This payment includes your income, Medicare taxes, and Social Security. QuickBooks ease your work by calculating federal tax for each quarter.

- Schedule C and Expense Categories: You need to use the schedule C form to report your self-employed income and expenses. It is also known as form 1040. Each time you categorize your transaction, QuickBooks Self-Employed matches it to a line on Schedule C. Schedule C helps you to show your financial reports.

- Send Data to TurboTax Self-Employed: QuickBooks Self-Employed tracks your self-employed income. You can export your tax data directly to the TurboTax Self-Employed. This prevents you from data entry errors and saves your time.

- Track Business Income and Expenses: Whenever you create or download a transaction in QuickBooks, you need to categorize it. After categorization, QuickBooks Self-Employed keeps your transaction on the correct line of your scheduled C. this helps to organize your income and expenses.

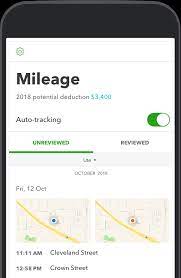

- Track Mileage: This is the main feature of the QuickBooks Self-employed that helps to track the vehicle expenses. If you drive for business purposes, you can deduct the vehicle expenses or rate per mile. You can download the mileage tracking app from the app store or play store.

Frequently Asked Questions (FAQs)

Can I access QuickBooks Self-Employed Online?

Yes, you can access QuickBooks Self-Employed by online and mobile app both. But in the mobile app, you can see some extra and helpful features which are not present in online mode. so, it is recommended to use the mobile app. It is free with the subscription.

What Does QuickBooks Self-Employed include?

QuickBooks Self-Employed include mileage tracking, tax calculating, sending data automatically to Turbo-Tax, separating personal income and expenses from business, and deductions.

How do I add transactions to QuickBooks Self-Employed?

You don’t need to add transactions manually. When you link your bank and credit card account to QuickBooks Self-Employed, it automatically downloads the new transactions. All you need to approve and categorize them so they show up in the scheduled C.

Does QuickBooks calculate federal tax itself?

As a self-employed, you need to pay federal tax quarterly and annual tax to the government. When you sign in for the QuickBooks Self-Employed, you need to set up your tax profile. QuickBooks makes your work easy by calculating tax itself.

Does QuickBooks Self-Employed come with Turbo-tax?

Tax Bundle is available for both QuickBooks Self-Employed and Turbo-tax Self-Employed. It separates your personal and business transactions. This helps you to calculate and send schedule C data to TurboTax, so you can pay your taxes directly.

We discussed login procedure, issues, cost, and features of the QuickBooks Self-Employed. Hope, this article is helpful to you. If you have any queries or need expert help, contact our QuickBooks ProAdvisor. Our team can help you and fix your problem instantly. Get in touch by dialing our toll-free number +1-855-525-4247.