Have you received an amount of income to your account, as QuickBooks cashback rewards? But, have no idea that how to record cashback rewards in QuickBooks? Don’t be hopeless, we will help you to enter your credit cash into the QuickBooks

In this article, we will guide you to record credit cash rewards in QuickBooks. And will discuss the different types of categories available for the cashback rewards.

Enter Cash Back Rewards in QuickBooks Online

QuickBooks Online cashback rewards can be entered or recorded in two different ways. But, here we only discuss the second method of recording cashback rewards. The QuickBooks Online, Desktop, and Pro users can follow the same procedure to record the cashback rewards.

Method 1: Offsetting of Expenses in QuickBooks Online

If you take a trip and spend a lot on the fare, you can apply the reward refund to the same travel expense category that you originally used for the transaction into multiple expense accounts. The main problem associated with this approach is that at the end of the year you won’t have the correct analysis of the expenses because it looks like you spent less than you did.

Method 2: Record Credit Cashback Rewards

Creating a credit card for cash-back rewards is one of the best methods to enter a cashback in QuickBooks Online. Follow the procedure to record a cashback;

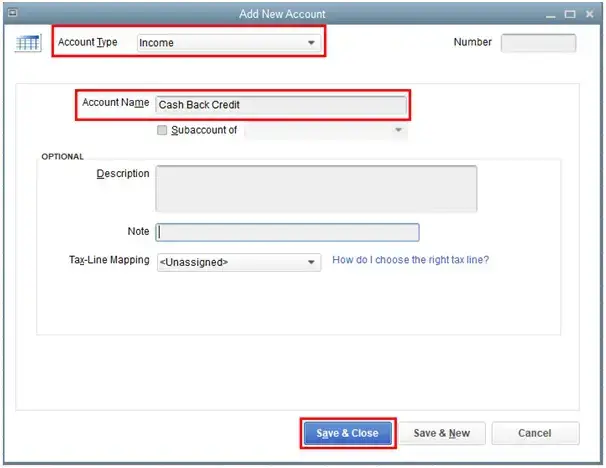

Step 1: Create an Income Account

In the first step, you need to create an income account in QuickBooks. Follow the below procedure to create an account;

- Open QuickBooks, and go to the ‘Accounting‘ section.

- From there, select the ‘Chart of Accounts‘ option, and click on the ‘New‘ option to select the Income.

- You can select your income, in the ‘Account Type‘ section.

- Consult with your ProAdvisor or accountant for the appropriate detail type.

- In the relevant field, enter the account name, and save all the changes that you have done.

- Lastly, close the tab.

Step 2: Create Credit Cards to Save the Rewards

In the second step, create a credit card to save or store rewards in QuickBooks Online. Follow the procedure to create a credit card;

- Go for the (+) sign.

- From the top of the menu, choose the ‘Credit Card‘ option, and the ‘Payee‘ option.

- Enter the Credit card account and the information related to the account.

- Then fill out the income under the ‘Account Column’.

- In the next step, enter the cashback amount, and save all things.

- Lastly, close the tab.

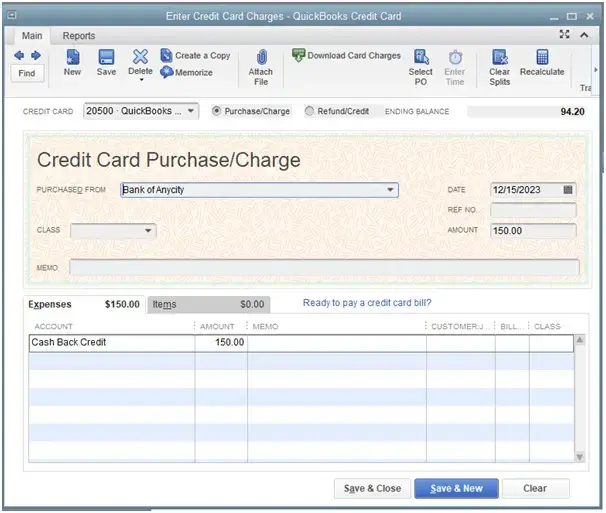

Step 3: Record the Cashback Credit Rewards

Now enter or record the rewards with the credit card in the QuickBooks, by following the below procedure;

- Again visit the ‘Banking‘ tab.

- And select the ‘Credit card Charges‘, then the ‘Purchased‘ Filed.

- Enter the name in the field, and select the created account.

- Again put the charge amount, and save all things, that you have done till now.

- Close the tab

Other Recommended Articles:

How to Turn On and Use Account Numbers for Chart of Accounts in QuickBooks Online

How to Set Up Job Costing In QuickBooks Desktop

How to Set Up Chart of Accounts in QuickBooks Desktop

Categorization of Cashback Rewards

The cashback rewards are not part of the business income. So it is easy to categorize all the rewards to the vendor’s check without any restriction. You can categorize the rewards in the following categories;

- Travel

- Assets, Supplies

- Commission & Fees

- Business Income

- Personal Deposit & Withdrawal

- Interest paid

- Home Office, Office Expenses

- Taxes and Licenses

- Advertising

- insurance

- Rent and lease

- Other Expenses of Business

Apart from that, QuickBooks has added some of the new categories for credit card rewards. Have a look to know, what are they;

- Rent and Lease: For lease and equipment rent

- Advertising: For listing fees

- Commission and Fees: For broker/referral/selling fees

- Car and Truck: For vehicle loan

- Interest Paid: For mortgage, business loan

- Other Business Expenses: For uniforms, furniture, subscriptions, or membership

- Insurance: For other property insurance

Issues Faced by Users While Recording Cash Back Rewards in QuickBooks

While entering the QuickBooks cashback rewards, you may face some situations. During that time, you need to understand the situation and take the next action to overcome the situation. Here we have shown you some of the scenarios, have a look;

- If you have no idea that, where the money is spent then you may tackle some questions. Like, what expense will be recorded in the refund amount, and what can be written in the field of description for each time.

- And in case, if you are using the same credit card every time to record the cashback rewards then you can’t know, where the refund will be submitted.

It was the complete article about the QuickBooks cashback reward, and its recording procedure. Hope you find it informative. Still, if you have any kind of doubts regarding this topic then you can drop a call through this toll-free number +1-844-405-0904, and can connect with the QuickBooks ProAdvisors for further support.