Have you forgotten to enter an opening balance, before the bank reconciliation in QuickBooks? Don’t worry, you can easily fix the mistake, and can come back to your business as usual. Read the article, till the end. We will show you how to overcome the situation when you forget to enter an opening balance in QuickBooks Online.

Note: You can only follow this process if you haven’t reconciled your account yet. And if in case, you reconciled your account, and searched for the solution to enter the opening balance later. Then you need to contact the QuickBooks ProAdvisors.

Other Recommended Articles:

QuickBooks -6144-82 Error Code: The Way of Quick Troubleshoot Solution

How to Setup QuickBooks Chart of Accounts

How to Manage your QuickBooks Advanced Inventory

The solution, If Opening Balance Is Not Entered in QuickBooks Online

Don’t be surprised after finding this situation, just follow the below steps to troubleshoot the unbalanced issue in QuickBooks Online.

From the first day, you create a new account in QuickBooks Online to start tracking the business transactions. And you enter the balance of the day manually so that every transaction can match from the start. This starting point is known as the Account’s Opening Balance.

But, if in case, you forget to enter the opening balance at the time of creating the account. Then this creates the unbalanced opening balance issue in QuickBooks.

If the opening balance is not entered in QuickBooks Online then, you may need to create a journal entry. Follow the below procedure to fix the unbalanced opening balance in QuickBooks.

Step 1: Ensure that You Don’t Already Have an Account Balance

You have to do nothing, just create a journal entry, and then visit your account register. Check at least two times that you don’t already have an account balance in QuickBooks Online. If you add one another then count all the transactions again.

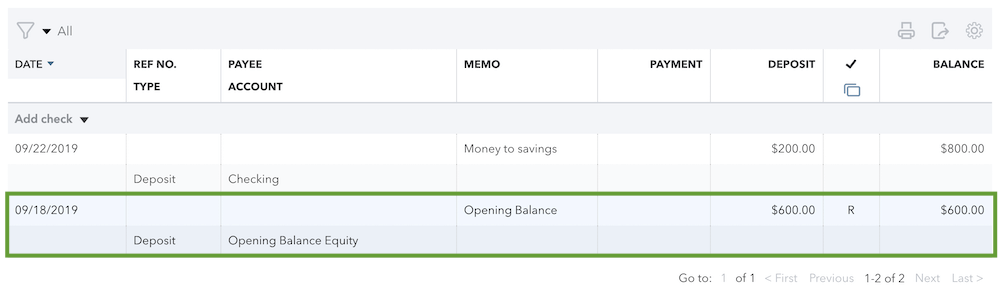

- Go to the Accounting Menu>>Charts of Accounts

- Browse your account and from the action column simply choose View Register

- Search your register for an opening balance, you will get Opening Balance Equity in the Payee/Account Column and Opening Balance in the Memo Column.

Note: If the opening balance appears to you then you don’t need to create a journal entry. Note down the date as well as the amount. Use your bank records just to check out the opening balance you will have is correct or wrong.

If the opening balance doesn’t appear to you, use the old transaction date and the amount in the account.

Step 2: Create a Journal Entry

If you didn’t find any opening balance entry, then create a journal entry.

- First of all, Choose + New

- Pick Journal Entry

- You have to enter the date that comes before the oldest transaction currently in the account (because the opening balance always comes before the oldest transaction). It can be treated as your new Opening Balance.

- Choose the account for which you want to enter the opening balance in the first line

- You have to use your bank statements for entering the right opening balance(it gives you an idea of the opening balance). It must be the balance of your account on the opening balance date:

- Assets: It includes all your savings and checking.

- Expense Accounts: In this field, simply enter the opening balance in the Debit column

- Liability, Equity, and Income Accounts: In this field, simply enter the opening balance in the Credit column

- Account Payable: In the Name Field, You can manually select the vendors you want to owe them money. Enter the amount as a credit if you are willing to increase the balance. Or you can enter it as a debit balance if you are willing to decrease the balance. You get a facility of creating separate lines for each vendor. The total amount of balance is equal to the opening balance.

- Account Receivable: In the Name field, choose the vendors who owe you money. Enter the amount as a credit if you are willing to decrease the balance. Or you can enter it as a debit balance if you are willing to increase the balance. You get a facility of creating separate lines for each customer. The total amount of balance is equal to the opening balance.

- On the Second Line, In the account column, Choose Opening Balance Equity.

- And write a short note, in the description field.

- Choose Save when you are ready and to accept the changes for completing the process

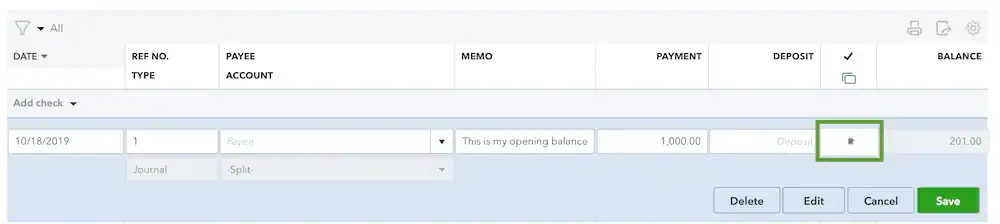

Step 3: Mark the Journal Entry as Reconciled

If you have not reconciled the account yet, It is required to reconcile the journal entry. This prevents you from showing future reconciliation.

- Visit the “Settings” and then move to the “Charts of Accounts”

- Browse and Navigate the account and then choose “View register” from the Action column

- Now browse for the journal entry of opening balance you have just created, Pick it for expanding the view

- Choose the box where the checkmark column presents until you can see an R. This will help you in reconciling the transaction.

- In the end, Choose “Save”

You got a journal entry for creating the opening balance. Entries are reconciled to remove ambiguity or you can’t count it again. This helps in balancing the account. Few steps are taken for those who are willing to reconcile the account.

If your account is still not balanced then you can consult with our Intuit Certified QuickBooks ProAdvisor, for further solutions through the toll-free number +1-844-405-0904. The experts will guide you to balance your account in the right direction.