Suppose you want to become a QuickBooks ProAdvisor and seek some platform where you get for preparation as well as self-assessment. In such conditions, this is the right platform for you to get all the essential information required for a QuickBooks ProAdvisor to qualify for the quickbooks certification exam 2024. Having a QuickBooks Online ProAdvisor certification will greatly enhance your trust and potential among your clients and employers.

In this modern business sector, everyone wants to grow within a specific duration of time in such situations Quickbooks accounting software has proved to be an essential tool for any organization to maintain its growth. That’s why the demand for this tool is increasing day by day and now students are also focusing on the preparation for quickbooks online certification exam answers and want to make their career as a QuickBooks ProAdvisor. To become a Pro adviser, one needs to crack the quickbooks online certification exam on which he gets the Quickbooks certification awarded by Intuit.

Want to know all the essential information as well as quickbooks online certification exam 2021 questions and answers for the preparation of this exam? This post is very critical for you as you will get complete information about the same.

Other Recommended Articles:

How to get Resolve QuickBooks Error 6000-83

QuickBooks Web Connector Error QBWC1085 – How to resolve?

How can Install Multiple QuickBooks Desktop Versions on One Computer

Sample QuickBooks Online Certification Exam Answers 2023

The sample QuickBooks Online Certification exam answers 2023 will assist you in preparing for the exam. It will also help candidates who are currently practicing QuickBooks Online Certification 2023 Questions and want to analyze the answers or questions. Here we will provide 230+ Questions and answers.

Question (1): What is the difference between the “Profit and Loss Report” and the “Balance Sheet Report”?

Answer:

P&L shows activities: income and expenses to arrive at Net Income (Profit) for a specific period.

The Balance Sheet shows values: Assets and Liabilities to arrive at Equity (Net Worth) as of a specific date.

The Net income from the Profit and Loss passes through the equity section on the balance sheet.

Question (2): Your client wants to transfer $500 from their checking account into a savings account to cover tax liabilities for sales made last month. Where should they start the process?

Answer: Navigate to the Quick Create icon, then find the Transfer link.

Question (3): Look at these two sentences about Undeposited Funds.

By posting to Undeposited Funds, you can create a single bank deposit for multiple payments, making it easy ___________.

When receiving a payment, make sure _________________.

Which of the options below correctly fills in the blanks?

Answer: To match your bank register with your bank statement; 2. The Deposit to the account is Undeposited Funds

Question (4): You have a client business that uses invoicing, the Accounts Receivable workflow, and they use the Banking screen to record a customer payment received. They select an income account and then select Add. What 2 problems will this cause?

Answer:

Their Accounts Receivable balance will not be accurate

The income account will show duplicate income

Question (5): When would you use to add other funds to this deposit grid in a Deposit Transaction? Identify the 3 correct options below.

Answer:

1. When an employee reimburses the company.

2. You receive a tax refund from the IRS.

3. When a company doesn’t record income using sales transactions (invoices or sales receipts) and wants to record deposits directly to income accounts.

Question (6): Which 2 of the transactions and tools in the list are Posting transactions?

Answer:

Credit memos

Vendor credits

Question (7): Which option has the correct information about how a delayed charge is used, and how it is created and linked to an invoice?

Answer:

Use a delayed charge to record a fee that you want to invoice in the future. The first step is to select a Delayed charge from the Quick Create menu, and then add it to an invoice later by selecting Add when the customer invoice is created.

Question (8): What 3 types of customer statements can be generated by QuickBooks Online?

Answer:

1. Statements that show a balance forward and then all activity between two specified dates.

2. Statements that show invoices created between two specified dates and their related payments.

3. Statements that show just open transactions.

Question (9): Clients can take payments from their customers’ credit cards via Online Invoicing if they have QuickBooks Payments set up. How does the customer interact with the invoice to access credit card payment features?

Answer: They select the Pay Now button.

Question (10): Look at the following process for matching and adding deposit transactions from a bank feed:

Select the line for that entry, and you’ll see more information in the row that expands

Select the Deposit link among suggested match(es) to view the deposit transaction

Hit Cancel in the bottom left and you’ll go back to the banking area

Now that we’re satisfied that this is the right banking activity matched to the right QuickBooks Online Transaction, we can ______________.

Which option correctly completes the final step?

Answer:

Hit Match on the right of the entry.

Question (11): The ____________ lists each customer with an open balance. It lists the open invoices in different columns based on whether they are current or how long it’s been overdue 30, 60, and 90+ days. What kind of report is being described here?

Answer:

A/R Aging Summary Report

Question (12): Your client wants to understand the difference between cash-based and accrual-based reporting. Which is the best definition of cash-based reporting?

Answer:

Cash-based reports display income as of the date the customer payment is received/recorded and expenses as of the date a vendor bill is paid.

Question (13): Read the following statement about recurring transactions in QuickBooks Online and the suggested steps to create one.

Statement: “Recurring transactions in QuickBooks Online can be set up to manage any of the first transactions in any workflow, like sales receipts, invoices, bills, journals, checks, deposits, or expenses”.

Suggested steps:

- Select the Quick Create icon

- Select Recurring transactions

- Select New

- Now choose Expense as the new Transaction Type from the drop-down list and hit OK

- On the new screen, enter Sult Advertising monthly fees as the template name. The best practice is to list the “Name” (Vendor/Customer/Employee) in the Template name. This makes it easier to identify what Names have recurring templates

- As the type, make it Scheduled. Which is true?

Answer:

Only the statement is correct

Question (14): Look at these steps for creating a project and a task in QuickBooks Online Accountant:

- _________________

- Select Create a Project in the top right

- Name the project Year-End

- Select the Client and enter four weeks from now as the due date

- Select Save

- Select your newly added Year-End project

- _________________

- Type in the Task name – Bank reconciliation and close books

- Due date – two weeks from now10. Select Save, Which option identifies the right steps for 1 and 7?

Which option identifies the right steps for 1 and 7?

Answer:

1. Select Work from the left menu;

7. Select Add a Task

Question (15): Your client, Client A, has a problem. He has several invoices that have not been paid by the customer after the customer became insolvent.

- Another client, Client B, needs to adjust invoices because of small overpayments by the customer on a series of invoices dating back six months.

- Which client or clients would need to use the Write-off invoices feature of QuickBooks Online to get their books corrected, and can they perform the task themselves?

Select the option that has the correct answer for both parts of the Question.

Answer:

Only Client A would benefit from the Write-off Invoices tool; No, the feature is only available to Accountant users via the Accountant Toolbox

Question (16): You have a client who needs a QuickBooks Online solution that includes tracking for sales and sales tax. Which subscription level in QuickBooks Online would you recommend?

Answer:

Simple Start, Essentials, or Plus

Question (17): Taking care of pay reports for employees and subcontractors is a key task when preparing for the year-end. Which of the 2 forms below would need to be sent?

Answer:

- W-2s are submitted for employees

- 1099s for subcontractors

Question (18): Which subscription option, if any, includes online banking, access from any device at any time, and integration with a wide range of apps?

Answer:

All QuickBooks Online Subscription levels.

Question (19): When would you need to reclassify transactions, and how would you do it in QuickBooks Online? Select the option that answers both parts of the Question correctly.

Answer:

To clean up large uncategorized expense accounts; go to Reclassify transactions in the Accountant Toolbox

Question (20): You can find the link to the Voided/Deleted Transactions tool by selecting the ___________________. Which option correctly completes the sentence?

Answer: Accountant Toolbox

Question (21): What steps are to import a list of products and services in QuickBooks Online?

- Select + New icon > Tools column > Import Data > Products and Services

- Select Accountant Tools > Tools column > Import Data > Products and Services

- Select Gear icon > Tools column > Import Data > Products and Services

- Select Gear icon > Account and Settings > Advanced > Import

Answer:

3. Select Gear icon > Tools column > Import Data > Products and Services

Question (22): Which statement is true regarding the Preferred Vendor field in Product and Services items?

- You can add more than one preferred vendor to each product/service item

- You can create a new vendor from the product/service information screen

- Preferred vendors must be assigned to utilize the Price rules feature

- You can reorder your list of preferred vendors

Answer:

2. You can create a new vendor from the product/service information screen

Question (23): What are 2 ways to add a customer to QuickBooks Online?

- Sales > Customers > Add New

- + New > Add Customer

- Sales > All Sales

- Gear icon > Add Customer

- Gear icon > Import Data

Answer:

1. Sales > Customers > Add New

4. Gear icon > Add Customer

Question (24): Which of the following buttons could you use to add a new vendor or find the link to import a vendor list into QuickBooks Online?

- The New Vendor button in the Vendors tab of the Sales screen

- The New Vendor button in the Vendors tab of the Expenses screen

- The New Vendor button in the Expenses tab of the Expenses screen

- The Enter Vendor Details button in the Expenses tab of the Sales screen

Answer:

2. The New Vendor button in the Vendors tab of the Expenses screen

Question (25): Where should you go to set up a new bank feed or link to a bank account in a client’s QuickBooks Online company?

- Expenses Center

- Accounting Center

- Sales Center

- Banking Center

Answer:

4. Banking Center

Question (26): In QuickBooks Online, what 4 data points do you need to set up sales tax for a client who only does business in their home state?

- Their company address

- Whether they have any criminal convictions

- Whether they travel to other countries

- When their last sales tax period started

- How often do they have to file a sales tax return

- When they started collecting sales tax for the agency

Answer:

1. Their company address

4. When their last sales tax period started

5. How often do they have to file a sales tax return

6. When they started collecting sales tax for the agency

Question (27): Which 4 methods allow clients to process digital payments from customers using QuickBooks Online Payments?

- Running a card through a card reader attached to a mobile device

- Entering payments manually as a Receive Payment

- Taking client payments via cryptocurrency

- Entering payments manually as a Sales Receipt

- Entering payments manually as a Credit Memo

- Sending a Sales Receipt to a customer via email

- Taking client payment via the Pay Now button on an emailed Invoice

Answer:

- Running a card through a card reader attached to a mobile device

- Entering payments manually as a Receive Payment

- Sending a Sales Receipt to a customer via email

- Taking client payment via the Pay Now button on an emailed Invoice

Question (28): Your client wants to open a new QuickBooks Payments merchant account. From inside QuickBooks Online, where can they go to sign up?

- In the Usage tab of Account and Settings

- In the Advanced tab of Account and Settings

- In the Payment tab of the Account and Settings

- In the Billing and Subscription tab of Account and Settings

Answer:

3. In the Payment tab of the Account and Settings

Question (29): Which 2 team user roles have permission to view and search for apps using the Apps tab in QuickBooks Online Accountant?

- Firm Master Admin

- Full Access Team User

- Custom Team User

- Basic Team User

Answer:

- Firm Master Admin

- Full Access Team User

Question (30): Where can a Master Admin Accountant User view the apps connected to a client’s QuickBooks Online account from within QuickBooks Online Accountant?

- Select the client from the Client List to open the Client Detail Page > Bookkeeping > View Connected Apps

- Left Navigation Bar > Apps > Client Apps

- In the Connected Apps column on the Client List dashboard

- Gear icon > Apps > Client Apps

Answer:

4. Gear icon > Apps > Client Apps

Question (31): Which are the 3 payroll options available inside QuickBooks Online companies?

- QuickBooks Online Do-it-Yourself Payroll

- QuickBooks Online Core Payroll

- QuickBooks Online Premium Payroll

- QuickBooks Online Elite Payroll

- QuickBooks Online Self-Service Payroll

Answer:

2. QuickBooks Online Core Payroll

3. QuickBooks Online Premium Payroll

4. QuickBooks Online Elite Payroll

Question (32): Which 3 features should you suggest to your clients to build their brand recognition on sales forms?

- Customize your fonts and use a font type that matches the company’s branding scheme

- Add the company logo to customer sales forms

- Use the standard template with no customization

- Add a splash of color that matches the company’s branding scheme

- Select a default payment method

Answer:

1. Customize your fonts and use a font type that matches the company’s branding scheme

2. Add company logo to customer sales forms

4. Add a splash of color that matches the company’s branding scheme

Question (33): Your client has called for help with their bank feeds in QuickBooks Online. You begin by asking them to open the Banking tab in the Left Navigation bar, and your client tells you that she doesn’t see this option listed.

What could be the reason?

- Your client doesn’t have bank feeds enabled

- Your client has Business View selected in their settings

- Your client has turned off the Banking option in their settings

- Your client has the Simple Start subscription for QuickBooks Online

Answer:

Your client doesn’t have bank feeds enabled

Question (34): What are the 3 benefits of adding non-QuickBooks Online clients to your Client List in QuickBooks Online Accountant?

- You can keep all client contact info, notes, and documents in one place

- You can access all your ProConnect Tax Online clients from the same dashboard

- You can launch your QuickBooks Desktop client companies directly from the Client Dashboard

- You can create projects and tasks for non-QuickBooks Online clients in the Work tab to stay on top of important client deadlines

- You can share documents stored in QuickBooks Online Accountant with the client

Answer:

- You can keep all client contact info, notes, and documents in one place

- You can access all your ProConnect Tax Online clients from the same dashboard

- You can create projects and tasks for non-QuickBooks Online clients in the Work tab to stay on top of important client deadlines

Question (35): A user wants to download an itemized invoice for the QuickBooks Online subscriptions on her wholesale billing account for last month.

The statement can be downloaded in which 2 file formats?

XLS or XLSX

- CSV

- JPEG

- DOC

Answer:

CSV, PDF

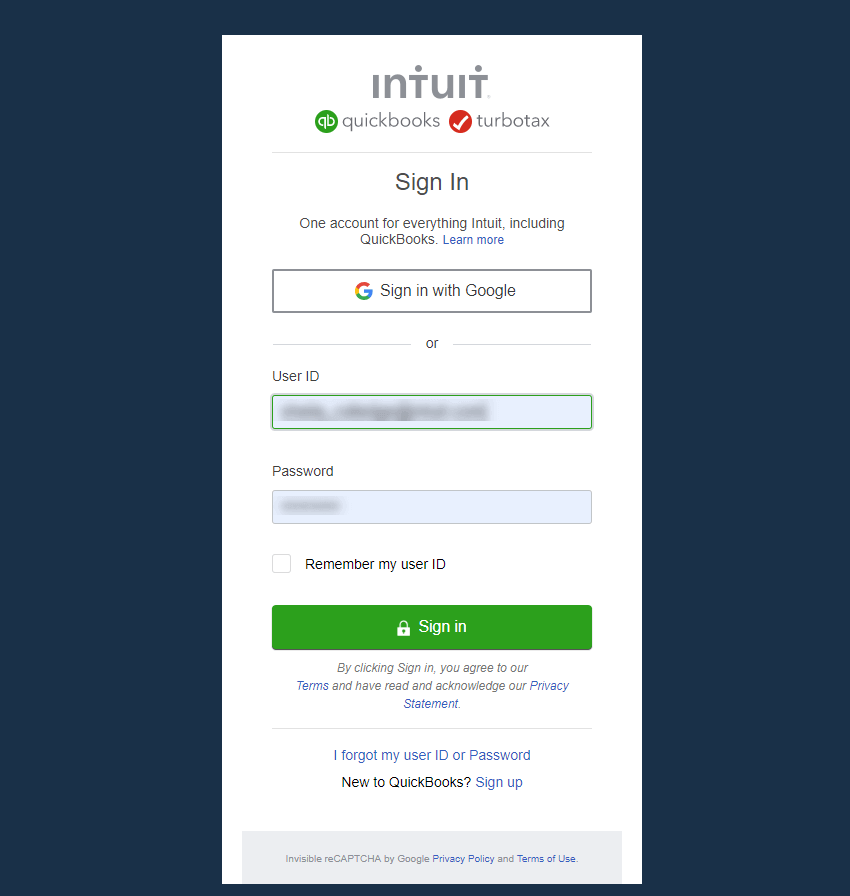

Question (36): Depending on the way your practice works, you may need to give team members different access levels based on their roles.

What are the 3 levels of access that can be granted to Team users of QuickBooks Online Accountant?

- Full access

- VIP access

- Basic access

- Custom Access

- Standard access

Answer:

Full access, Basic access, Custom Access

Question (37): What is the correct process for setting up a recurring project for the same client?

- Create a new project and select the Repeat button, then set the frequency and duration

- Create the project and save it. Reopen the project and select the Duplicate button for the number of times you want it to recur

- You can’t repeat projects, only tasks

Answer:

Create a new project and select the Repeat button, then set the frequency and duration

Question (38): Based on the relationship and agreement with the vendors, what are the 2 vendor workflow options to pay your vendors?

- Bill > Pay Bills

- Invoice > Receive Payment > Create Deposit

- Create Purchase Order

- Expense or Check

- Delayed Charge > Pay Bills

Answer:

1. Bill > Pay Bills

3. Create a Purchase Order

Question (39): Look at these two sentences about Undeposited Funds:

By posting to Undeposited Funds, you can create a single bank deposit for multiple payments, making it easy ___________.

When receiving a payment, make sure _________________.

Which option correctly fills in these two sentences?

1. To match your bank register with your bank statement; 2. The Deposit to the account is Checking

1. To match your bank register with your bank statement; 2. The Deposit to the account is Uncategorized Funds

1. To match your expenses with your bank statement; 2. The Deposit to the account is an Uncategorized asset

1. To match your bank register with your bank statement; 2. The Deposit to the account is Undeposited Funds

Answer:

1. To match your bank register with your bank statement; 2. The Deposit to the account is Undeposited Funds

Question (40): Someone is teaching his/her client proper vendor workflow.

What is the correct workflow?

- Purchase Order > Pay bill

- Bill > Print checks

- Bill > Pay bill

- Invoice > Pay bill

Answer:

Purchase Order > Pay bill

Question (41): When the Sales Tax feature is enabled in QuickBooks Online, where must you record sales tax payments?

- Create Bill

- Sales Tax Center

- Create Check

- Pay Bills

Answer:

Sales tax center

Question (42): What are 2 tools you can use to identify possible issues in a QuickBooks Online company?

- Transaction Journal

- Import Data

- Account and Settings

- Audit Log

- Journal Entry

Answer:

- Transaction Journal

- Audit Log

Question (43): What steps are to create a new estimate in QuickBooks Online?

- Projects > All Sales > New Transaction > Estimate

- Sales > Customers > New Customer

- Sales > All Sales > New Transaction > Estimate

- Gear icon > Estimate

Answer:

Sales > All Sales > New Transaction > Estimate

Question (44): Stacy wants to run reports that tell her which vendors provide the best prices on the products she sells.

Which 2 vendor workflows in QuickBooks Online enable her to create reports with this data?

- Create Bill with product/service items > Pay Bill

- Create Expenses with product/service items

- Create Expenses with account/category detail

- Create an Invoice with product/service items

- Create Bill with account/category detail > Pay Bill

Answer:

- Create Bill with product/service items > Pay Bill

- Create Expenses with account/category detail

Question (45): Which report should you run to list all customers who currently owe balances, and how old those balances are?

- Accounts Payable Aging Summary

- Accounts Receivable Aging Summary

- Balance Sheet

- Trial Balance

Answer:

Accounts Receivable Aging Summary

Question (46): Kathryn is concerned about her cash flow and wants to know how much she spent with each of her vendors last month.

Which report in QuickBooks Online would provide that information?

- Accounts Payable Aging

- Profit and Loss

- Balance Sheet

- Expenses by Vendor Summary

Answer:

Expenses by Vendor Summary

Question (47): _________ is designed to support the most common workflows and tasks to close a client’s monthly books.

It consists of the following three workflow tabs:

__________

__________

__________

Fill in the blanks.

- Month-end review, Transactions, Accountant review, Final review

- Overview, Transaction review, Accountant reconciliation, Final review

- Month-end review, Transaction review, Account reconciliation, Final review

- Overview, Transactions, Accountant review, Final review

Answer:

2. Overview, Transaction review, Accountant reconciliation, Final review

Question (48): The first stage in the month-end process is reviewing transactions and recognizing any possible issues.

What are the 2 open issues that can be viewed from the Transaction review tab?

- Reclassified transactions

- Uncategorized transactions

- Transactions without payees

- Transactions without accounts

- Transactions with attachments

Answer:

- Uncategorized transactions

- Transactions without payees

Question (49): To keep track of her team, Esther has requested that the status of each task be updated in the Month-end review tabs.

What are the 3 status options?

- Open, pending, done

- To do, waiting, complete

- Open, pending, and complete

- To do, waiting, do

Answer:

Open, pending, and complete

Question (50): What are the 2 limitations of the Reclassify Transactions tool?

- You can’t change the payment bank account when reclassifying expenses

- You can’t change the Classes when reclassifying expenses

- You can’t change the Locations when reclassifying expenses

- You can’t change the account for inventory adjustments

- You can’t change the Classes for deposit types

Answer:

- You can’t change the payment bank account when reclassifying expenses

- You can’t change the Classes for deposit types

Question (51): When should an Accountant user use the Write-Off tool?

- When a client has overpaid

- When a client has outstanding invoices that will not be paid

- When you wish to remove a duplicate transaction

- When a user wants to categorize several transactions quickly

Answer:

When a client has outstanding invoices that will not be paid

Question (52): Where can you find the link to the Voided/Deleted Transactions tool?

- Accountant Tools

- Gear icon

- + New icon

- Banking screen link in the Left Navigation Bar

Answer:

Accountant Tools

Question (53): What are 4 options you can access via Accountant Tools?

- Reclassify transactions

- Reconcile

- Recurring transactions

- Close books

- Reports options

- Audit log

- My Experts

Answer:

1. Reclassify transactions

2. Reconcile

3. Recurring transactions

5. Reports options

Question (54): IRS guidelines require specific information to substantiate deductible automobile expenses.

Which 3 items are included in the substantiation requirements?

- Vehicle type, date placed in service, and total mileage (including business, commuting, vacation, and personal)

- Vehicle type, the number of days driven, and the total mileage (including business, commuting, vacation, and personal)

- Vehicle type, date placed in service, and total mileage (including business, commuting, and personal)

- Vehicle type, the number of days driven, and the total mileage (including business, commuting, and personal)

Answer:

Vehicle type, date placed in service, and total mileage (including business, commuting, vacation, and personal)

Question (55): You have set a closing date with a password. Can your client make changes and if so, how would you track any changes to transactions within the closed period?

- Yes, but only if they know the password. There is no way to track changes

- No. Even if they know the password, they can’t change transactions on or before the closing date. Only the accountant can track changes

- Yes, but only if they know the password. Changes are flagged in an exception to the Closing Date report

- Yes, they can change transactions even without the password. Changes are flagged in an exception to the Closing Date report

Answer:

3. Yes, but only if they know the password. Changes are flagged in an exception to the Closing Date report

Why might an Accountant user not see the Exceptions to Closing Date report in a QuickBooks Online company?

Question (56): Why might an Accountant user not see the Exceptions to Closing Date report in a QuickBooks Online company?

- A closing date has not been set in the company

- The Accountant user does not have the required permissions to view the report

- The Exceptions to Closing Date report is not available in a Simple Start subscription

- The Audit Log is not enabled

Answer:

The Accountant user does not have the required permissions to view the report.

Question (57): When using the Copy to Purchase Order feature from within an Estimate, where do you need to turn on Use Purchase orders?

- Account and Settings > Products and Services

- Expenses > Purchase orders

- Account and Settings > Expenses > Purchase orders

- Vendors > Purchase order

Answer:

3. Account and Settings > Expenses > Purchase orders

Question (58): Different customer statement types are available to suit different client situations. Heather wants to help her client send out a statement that reflects all unpaid invoices, unapplied payments, and Credit Memos.

Which statement type should she choose?

- Balance Forward

- Open Item

- Transaction Statement

- Client Open Balance

Answer:

Open Item

Question (59): What are 2 ways to access the vendor credit screen in QuickBooks Online?

Sales Center > New Invoice

- Gear icon > Vendor Credit

- Expenses Center > Import Transactions

- + New button > Vendor Credit

- Expenses Center > New Transaction > Vendor Credit

Answer:

3. + New button > Vendor Credit

4. Expenses Center > New Transaction > Vendor Credit

Question (60): When might you use the Bank Deposit Transaction?

- Your client wants to apply a customer payment to an open invoice

- Your client wants to record an SBA loan amount received

- Your client wants to record sales from her upcoming trade show and provide sales receipts

- Your clients want to refund a customer

Answer:

2. Your client wants to record an SBA loan amount received

Question (61): Where can a client identify the instant deposit options for their QuickBooks

Payments account?

Deposits tab

- Account and Settings

- Invoices tab

- Create Invoice screen

- Banking Center

Answer:

Account and Settings

Question (62): What is the additional percent fee when using QuickBooks Payments Instant Deposits?

- 2

- 1.5

- 1

- 2.5

Answer:

3. 1

Question (63): Which 3 statements are true about journal entries?

- Total debits must equal total credits

- You can post to Products and Services in a journal entry

- When posting to the accounts receivable account, you must specify a vendor

- When posting to the accounts receivable account, you must specify a customer

- You can post to multiple accounts receivable and/or accounts payable accounts in the same journal entry

Answer:

- Total debits must equal total credits

- When posting to the accounts receivable account, you must specify a customer

- You can post to multiple accounts receivable and/or accounts payable accounts in the same journal entry

Question (64): The Pay down credit card feature can be found in which area of QuickBooks Online?

- Gear icon

- + New on the Left Navigation Bar

- Account and Settings

- Banking Center

Answer:

+ New on the Left Navigation Bar

Question (65):

1. Select the + New button from the Left Navigation Bar

2. Select _______ in the Other column

3. Select the credit card account that is being paid

4. Select the ____________, if applicable

5. Enter how much was paid

6. Enter the date of payment

7. Select the account the payment is being made from next to “What did you use to make the payment?”

8. Select ______________.

Which option completes the 3 missing steps to use the Pay down credit card feature?

- Pay down your credit card, and account number, Submit the payment

- Transfer, Payee, Schedule payment

- Pay down the credit card, Payee, and Save

- Transfer, account number, Save

Answer:

3. Pay down the credit card, Payee, Save

Question (66): Your client wants to transfer $500 from their checking account into a savings account to cover tax liabilities for sales made last month.

Where should your client go to find the Transfer link?

- Gear icon

- + New

- Sales screen

- Banking screen

Answer:

Banking screen

Question (67):

One major benefit of using the Bank Feeds feature in QuickBooks Online is that as you _________________ or __________________ transactions in QuickBooks Online from the downloaded transactions from the bank, they are marked ___________________. This makes the end-of-period bank reconciliation more efficient.

Which option correctly completes these statements?

- Record, delete, and reconcile

- Match, exclude, cleared

- Match, add, cleared

- Exclude, add, and reconcile

Answer:

Exclude, add, reconciled

Question (68): A user accidentally added a new transaction to his/her bank register via the bank feed that should have been matched to an existing transaction.

Where in the Banking Center should she/he go to find the transaction and correct the error?

- Gear icon

- Filter

- For Review

- Categorized

Answer:

Categorized

Question (69): How can you filter the For Review tab to see all the transactions QuickBooks Online thinks it has found a good match for?

- Select the All transactions drop-down, then Matched

- Select the All transactions drop-down, then Recognized

- Click on the Gear icon, then select Show only matches

- Select the All Transactions drop-down, then Included

Answer:

Select the All transactions drop-down, then Recognized

Question (70): MB has been using proper workflow for her sales process by creating invoices, receiving payments, and recording deposits using the transaction screens in QuickBooks Online. Most likely, she will be able to ___________ downloaded deposits to ____________ transactions in the Banking Center.

Which option correctly completes the sentence?

- Add, new

- Add, existing

- Match, existing

- Match, new

Answer:

Match, existing

Question (71): Which option correctly explains the steps to enable email receipt forwarding in QuickBooks Online?

- Gear icon > Account and Settings > Expenses > Receipts > Register your email to get started

- Gear icon > Account and Settings > Advanced > Automation > Turn on receipt forwarding

- Banking > Receipts > Turn on receipt forwarding

- Banking > Receipts > Forward from email

Answer:

Gear icon > Account and Settings > Expenses > Receipts > Register your email to get started

Question (72): The Receipt Capture feature in QuickBooks Online allows users to add receipts to QuickBooks using which 3 methods?

- By forwarding an email to [youruniquename]@qbodocs.com from a registered email

- By forwarding an email to companyname@quickbooks.com from a registered email

- By snapping a picture via the mobile app

- By snapping a picture via a browser

- By uploading a file via a browser

- By texting receipts@quickbooks.com

Answer:

- By snapping a picture via the mobile app

- By uploading a file via a browser

- By texting receipts@quickbooks.com

Question (73): In which 2 situations might a transaction need to be excluded from bank feeds?

- If the downloaded transaction was already recorded and reconciled in QuickBooks Online

- If the bank downloads the same transaction more than once

- If the posting date and actual payment date don’t match in the bank feed

- If the bank description doesn’t match the payee’s name

Answer:

- If the downloaded transaction was already recorded and reconciled in QuickBooks Online

- If the bank downloads the same transaction more than once

Question (74): Which 3 statements regarding bank rules are true?

- Bank rules can be prioritized

- Bank rules are only included in QuickBooks Online Plus or Advanced subscriptions

- Bank rules can be copied, edited, or deleted

- Only an Accountant user can set up bank rules in QuickBooks Online

- There is an additional fee to use bank rules in QuickBooks Online

- You can automatically add transactions to the register using bank rules

Answer:

- Bank rules can be prioritized

- Bank rules can be copied, edited, or deleted

- You can automatically add transactions to the register using bank rules

Question (75): Which 2 statements are correct regarding reconciling a bank account in QuickBooks Online?

- You can only undo a bank reconciliation via a link in Accountant Tools

- To successfully reconcile and run a reconciliation report, you need to enter the Statement Ending Date and Ending Balance from the relevant bank statement

- Reconciliations must only be run at the period end to estimate tax owed

- To see the Reconciliation report, select View Report after you’ve successfully reconciled the account

Answer:

- To successfully reconcile and run a reconciliation report, you need to enter the Statement Ending Date and Ending Balance from the relevant bank statement

- To see the Reconciliation report, select View Report after you’ve successfully reconciled the account

Question (76): How would you begin setting up a recurring transaction in QuickBooks Online?

- Select Create > Recurring Transactions

- Select the Gear icon > Recurring Transactions

- Select Accountant Tools > Recurring Transactions

- Select the Gear icon > Account and Settings > Advanced > Enable Recurring Transactions

Answer:

Select the Gear icon > Recurring Transactions

Question (77): What are the names of the three tabs listed across the top of the Reports Center?

- Favorites, Custom reports, Management reports

- The business overview, Favorites, Custom reports

- Standard, Business overview, Custom reports

- Standard, Custom reports, Management reports

Answer:

Standard, Custom reports, Management reports

Question (78): Which report accounting method shows an overview of the money received and spent for a specific period?

- Hybrid basis

- Accrual basis

- Modified basis

- Cash basis

Answer: Accrual basis

Question (79): What reports in QuickBooks Online will show whether a client was profitable for a specific period?

- Balance Sheet

- Accounts Receivable Aging

- Profit and Loss

- Trial Balance

Answer:

Profit and Loss

Question (80): How do you record a debit card transaction in QuickBooks?

Answer:

Use the write check window for the check register, but type debit in the check number field

Question (81): The computer that houses your QuickBooks data could crash. What should you do in QuickBooks to make sure you always have access to your data?

Answer:

Create a backup copy of your company files and store it separately from the computer

Question (82): List entries may be deleted only when:

Answer:

There is no balance, it has not been used and is not linked to anything that has been used.

Question (83): You sent a QuickBooks report to Excel and made some changes. How do you import the change in Excel back to QuickBooks?

Answer:

Use the import from the Excel wizard in QuickBooks

Question (84): Which of the following statements is true regarding single-user and multi-user modes?

Answer:

To use QuickBooks in multi-user mode, each user must have the same version of QuickBooks on their computer to access the same company file

Question (85): Which of the following elements on an invoice can you not customize?

Answer:

The amount of information, and the number of characters you can type in each field.

Question (86): Which statement about creating a client request in QuickBooks Online Accountant is false?

- You can add attachments by selecting the + Add document link

- The request is not sent to the client’s email address unless the default setting is changed.

- The request appears in the client’s QuickBooks Online company in My Accountant

- If you wish to notify your client of your request with a QuickBooks Online-generated email, select Notify client

Answer:

2. The request is not sent to the client’s email address unless the default setting is changed.

Question (87):– The Opening Balance Equity account should always be zero. If you see a balance here, it’s most likely because an amount was entered in the opening balance field when?

Answer:– During the creation of a new customer, vendor, balance-sheet account, or inventory product

Question (88):– In the Client Overview Tab under Transaction Volume, what is the latest date you can see?

Answer:–

Up to 30 days

Question (89):– The Accountant User and Clients with the Advanced subscription have access to The Client Overview. What are some benefits of the Client Overview?

Answer:–

Concise subscription information, recent banking activity stats, and early indications of banking errors

Question (90):– What are the five benefits of using apps?

Answer:–

- Reduce data entry

- Solve industry-specific tasks

- Streamline workflow processes

- Expand business insight

- Security and/or separation of duties

Question (91):– All apps are pre-categorized into the tasks they help resolve

Answer:–

By selecting the Browsing Category, you can filter apps by the problem you are trying to solve.

Question (92):– What are the two ways to search an app in QuickBooks Online?

Answer:–

Using the search box or by category

Question (93):– Which is the most popular time-tracking app available in QBO?

Answer:–

T-sheet

Question (94):– What subscriptions would you suggest to track sales and sales tax?

Answer:–

Simple Start, Essentials, Plus, and Advanced

Question (95): During the Advanced Setup, you can turn on and off which features in the EasyStep Interview.

- Sales taxes

- Inventory

- Progress Invoicing

- All of the above

Answer:

All of the above

Question (96): During the Advanced Setup, you can set up a password for which of the following users during the EasyStep Interview?

- Administrator

- External Accountant

- You cannot set up passwords during the EasyStep interview

- All users

Answer:

Administrator

Question (97): When setting up a new company through the Advanced Setup, some company information is optional and some are required. Which of the following pieces of information does QuickBooks require you to enter during the EasyStep Interview?

- Company name

- Company password

- Tax ID

- All of the above

Answer:

Company name

Question (98): How do you set up multiple businesses in QuickBooks (assuming each business files a separate tax return)?

- Purchase a separate QuickBooks license for each company you need to set up.

- Use the Advanced Setup to go through the EasyStep interview for the oldest

- Use the Advanced Setup to go through the EasyStep interview for each company

- Use the Advanced Setup to go through the EasyStep Interview for the largest company first, and then choose File > Add a separate business at the end of the interview. to create a separate company file.

Answer:

Use the Advanced Setup to go through the EasyStep interview for each company

Question (99): During the Advanced Setup, how do you set up a new account that is not on the default list of accounts during the EasyStep Interview?

- You can’t add accounts that are not on the QuickBooks default list. Finish the interview and add the accounts directly to the Chart of Accounts.

- Click Add new account in the EasyStep Interview.

- Click Edit Account during the EasyStep Interview.

- Select Import My Chart of Accounts during the EasyStep Interview.

Answer: You can’t add accounts that are not on the QuickBooks default list. Finish the interview and add the accounts directly to the Chart of Accounts.

Question (100): You’ve been hired by a company that started in 1911. They’ve never used QuickBooks. During the Advanced Setup, what “Start Date” should you use in the EasyStep Interview?

- There is no Start Date in the EasyStep Interview.

- The date the company bought QuickBooks.

- 1911

- The date you want to begin tracking the company’s finances in QuickBooks.

Answer:

The date you want to begin tracking the company’s finances in QuickBooks.

Question (101): How do you restore a company file from a backup copy?

- Choose File > Back Up. Then click the Restore from the Backup button.

- Choose File > Utilities > File Operations > Restore.

- Choose File > Open or Restore Company. Select Restore a backup copy and click Next. Choose Local or Online Backup and click Next. Select the file to restore and click Open. Decide where to restore the file and click Save.

- Click the Restore icon on the Home page. Click the Next option.

Answer:

Choose File > Open or Restore Company. Select Restore a backup copy and click Next. Choose Local or Online Backup and click Next. Select the file to restore and click Open. Select where to restore the file and click Save.

Question (102): Which of the following is NOT a backup option in QuickBooks?

- Manually back up the file.

- Automatically back up the data file when closing QuickBooks.

- Schedule an unattended backup

- All of the above are QuickBooks backup options.

Answer:

All of the above are QuickBooks backup options.

Question (103): Why would you restore a data file from the backup file?

- You wish to review the company data as it stood at an earlier date.

- The company data file on your hard drive is damaged and cannot be used.

- Your computer crashed. You reloaded QuickBooks, and now you are ready to open the company file.

- All of the above.

Answer: All of the above

Question (104): How do you switch to Multi-User Mode?

- Choose Company > Set Up Users and Passwords > Set Up Users from the

- Open the data file from a remote location.

- Choose Edit > Preferences > Multi-User from the menu.

- Choose File > Switch to Multi-user Mode from the menu.

Answer:

Choose File > Switch to Multi-user Mode from the menu.

Question (105): If you decide to remove transactions as of a specific date from the “Condense Data” window, what does QuickBooks do?

- Removes all payroll transactions that occurred on that date. This is a great way to fix the mistakes a new person made on a particular day.

- Removes all transactions while leaving lists, preferences, and service subscriptions intact.

- Changes the company’s start date.

- Deletes all transactions, as well as user passwords and access privileges.

Answer:

Removes all transactions while leaving lists, preferences, and service subscriptions intact.

Question (106): What happens when you press F2 in QuickBooks?

- Nothing, because function keys are not designed to work with QuickBooks.

- QuickBooks opens the Help.

- QuickBooks opens the Product Information window, which includes version and company file information.

- QuickBooks closes all windows.

Answer:

QuickBooks opens the Product Information window, which includes version and company file information.

Question (107): When would you enter a journal entry?

- To correct errors (if you have a strong accounting background)

- For year-end adjustments

- To enter depreciation

- All of the above

Answer:

All of the above

Question (108): If the computer that houses your QuickBooks data crashes, what should you do?

- Restore a backup copy of your company file

- Create a backup copy of your company file

- Condense your company file data

- Export your data to Excel

Answer:

Restore a backup copy of your company file

Question (109): When you start a company or are hired as a bookkeeper, it is important to know which edition of QuickBooks you are using. What are the major QuickBooks editions?

- QuickBooks Online, QuickBooks Pro, QuickBooks Premier, QuickBooks Enterprise Solutions

- QuickBooks Online, QuickBooks Basic, QuickBooks Pro

- QuickBooks Basic, QuickBooks Pro

- QuickBooks Premier, QuickBooks Enterprise Solutions

Answer:

QuickBooks Online, QuickBooks Pro, QuickBooks Premier, QuickBooks Enterprise Solutions

Question (110): Which of the following could explain why a profit and loss show a profit, but the business owner doesn’t have any money in the bank?

Answer:

This is the difference between cash and accrual reporting.

Question (111):- You have to set up the item for shipping. What item type should you use?

Answer:

Other charges

Question (112):- Which of the following elements on an invoice can you not customize?

Answer:

The amount of information, and number of characters you can type in each field.

Question (113):- Your company just hired a contractor to work 40 hours per week on a job. Which list should you add this person to?

Answer:

Vendor

Question (114):- Where would you go in QuickBooks Online to see the range of default and extra lists that are available?

- Sales Center > Settings > All Lists

- + New button > All Lists

- Gear icon > All Lists

- Sales Center > Settings > Add Lists

Answer:

2. + New button > All Lists

3. Gear icon > All Lists

Question (115):- Where would you go to find all the lists you can use to fill in forms in QuickBooks Online?

- Gear icon > All Lists

- + New icon > All Lists

- Accounting screen > All Lists

- Reports screen > All Lists

Answer:

1. Gear icon > All Lists

Question (116):- Which 3 navigation features are missing in a Reports Only user’s view?

- Navigation panel

- Search box

- + New button

- Gear icon

- Help menu

Answer:

- Navigation panel

- + New button

- Gear icon

Question (117):- What types of user permissions can you set up when adding a new team member in QuickBooks Online Accountant?

- Regular or custom user, Company administrator, Reports only, and Time Tracking only

- Basic, Custom, and Full Access

- Regular or custom user, Company administrator, and Reports only

- Regular or custom user and Company Administrator

Answer: Basic, Custom, and Full Access

Question (118):- The majority of your time working with QuickBooks Online will be spent utilizing a form, a list, or a:

Answer:-

Register

Question (119):- When you select the Paycheck List tab, you will be sent to the Payday tab where you can view and print checks, delete checks, or change check numbers. The statement is true or false:

Answer:-

True

Question (120):- What would you do to organize the Vendors list in the Vendor Center if you found two or more names with a similar spelling that belonged to the same vendor?

Answer:-

Merge similar vendor names

Question (121):- To view cleared checks, which account register do you open?

Answer:-

Checking account

Question (122):- Which of these transactions involving the vendor cannot be started with a single click from the “Quick Create” menu:

- Create new vendor

- Write Check

- Cash Expense

- Vendor Refund

Answer:-

Create a new vendor

Question (123):- Why is creating a password and closure date highly advised?

Answer:- It sends an automatic email to the accountant

Question (124):- Which of the following Company Settings needs to be chosen to enable online invoices:

- HTML emails

- Include the invoice as a PDF attachment

- Include sales forms as PDF attachments

- Email a link to customers to pay invoices online

Answer:- Email a link to customers to pay invoices online

Question (125):- Where in QuickBooks Online is the transfer funds feature?

- Banking tab

- Home page

- Quick create

- Transactions tab

Answer:-

Quick create

Questions (126):- What are QuickBooks’ two main reports?

Answer:-

The balance sheet and the profit and loss report are the two main reports in QuickBooks.

Questions (127):- What is the most recent date you may see under Transaction Volume in the Client Overview Tab?

Answer:-

Upto30 days

Question (128):- For each functional area QuickBooks, Pro & Premier, for example, sales and accounts receivable, purchases, and accounts, etc. What level of access can you grant to use it?

Answer:

You can prohibit access, grant access or grant selected access. These levels, all transactions within that area.

Question (129):- Which of the following is not a billing option when you prepare a progress invoice?

Answer:

Invoice for hours entered on the timesheet.

Question (130):- Which list represents the payroll services you can add to QuickBooks?

Answer:

Basic calculates taxes and helps create state and federal tax forms and assisted intuit handles payroll taxes and forms

Question (131):- Which of the following additions of QuickBooks supports multi-users?

Answer:

All versions support multi-users.

Question (132):- What can you do in the report center?

Answer:

Run most reports in QuickBooks.

Question (133):- How can you open a QuickBooks report in Microsoft Excel?

Answer:

Click the Excel button on the top of any QuickBooks report.

Question (134):- Which two steps do you follow to track accounts payable in QuickBooks?

Answer: Enter bills, pay bills.

Question (135):- How do you display a group of reports?

Answer:

Click the reports menu and select process multi-reports.

Question (136):- Your company supplies them with sick, vacation hours. You need to track how many hours that each employee currently has available, how many they earn, accrued hours when you pay them for sick or vacation time. How do you do this in QuickBooks?

Answer:

Follow these steps:

- Click the sick, vacation button in employees setup to define how to approve time and to tell QuickBooks how many hours the employee has available.

- Setup a sick, vacation wage item. Use a sick, vacation wage item to pay employees for sick, vacation time.

Question (137):-

Which payroll service allows you to print state tax forms?

Answer: Enhanced payroll

Question (138):-

Which of the following transactions cannot be memorized?

Answer: Bill payment

Question (139):-

How do you ensure that no one accidentally deletes, edits, or adds transactions to last year?

Answer:

Set a closing date and password in the accounting preferences or from the company menu.

Question (140):-

How do you make a column on a report wider?

Answer:

Click the diamond to the right side of the column and drag it to the right.

Question (141):-

How do you pay, payroll liability in QuickBooks?

Answer:

Select the payment you want to make from the pay schedule liability. Select view pay.

Question (142):-

What is the purpose of the audit trail report?

Answer:

Track any changes or deletions to transactions as well as track which users make the changes or deletions.

Question (143):-

You accidentally entered a customer twice in the customer center with a slightly different spelling. How do you merge these two entries?

Answer:

Edit the unwanted list entry; change the name to match the name you want to merge into. Click ok, then click yes when prompted to merge names.

Question (144):-

Your company had to return some goods to a vendor. How do you record the vendor credit in QuickBooks?

Answer:

Click the enter bills then click credit on top of the bill.

Question (145):-

When you set up a new employee, how do you add a payroll deduction such as medical insurance?

Answer:

In the new edit employee window, click the change tab drop-down window, select payroll and compensation information, then add the medical insurance payroll into the addition/deletion and company compensation section.

Question (146):-

What is the result of the payroll setup interview?

Answer:

QuickBooks has an accurate record of employees’ earnings and deductions and payroll history and you are ready to create your first paycheck.

Question (147):-

Two primary financial statements summarize the chart of accounts.

Answer: Balance sheet

Question (148):-

Once you have completed the sign of the new company file, how do you change company information such as business name, address, or phone number?

Answer: Select company information from the menu.

Question (149):-

Suppose you work for a pet store and have to track the name of each customer’s pet. How would you do this in QuickBooks?

Answer: Add a custom field to the customer list

Question (150):-

The company file you are working on is a mess. You decided to start a new file. To save time, you want to keep all the lists and preferences and just delete the transactions. How do you do this?

Answer:

Click the file menu. Select utilities, condense data from the menu then choose the all transaction option.

Question (151):-

Which is an example of when to use a non-inventory part?

Answer:

When you buy and sell an item but do not need to track quantity on hand information.

Question (152):-

Which of the following cannot be entered during the setup of a new company?

Answer: Trail balance, open balance

Question (153):-

When you enter profit and loss on the accrual basis what does QuickBooks include as income?

Answer: All sales.

Question (154):-

When should you void instead of deleting a check?

Answer: Use a check number but it will never be cashed.

Question (155):-

Your company sells unique items to every customer. Then never sell the same product or service twice. What item should you set up in QuickBooks?

Answer:

Set up a generic item and edit the description and price and time.

Question (156):-

Which of the following form templates cannot be customized in QuickBooks?

Answer: Check

Question (157):-

Which is not a good reason to enter a general journal entry?

Answer:

To avoid using the built-in forms.

Question (158):-

The bank notifies you that a customer’s check you have deposited has bounced. The customer did not have sufficient funds to cover the check. What should you not do?

Answer:

Delete the customer’s payment from the deposit.

Question (159):-

How do you change the text in the header/footer report?

Answer:

Click the customize button on the report and then click the header/footer tab.

Question (160):-

Why would you hide or collapse subaccounts on a report?

Answer:

To temporarily hide unnecessary detail and hide parent accounts.

Question (161):-

What should you do after you click save and close on a customer credit memo?

Answer:

Choose between retained as available credit, give a refund or apply to an invoice.

Question (162):-

The bank notified you that a customer’s check you deposited had bounced. The customer did not have sufficient funds to cover the check. What should you do?

Answer:

Record a transaction to show the customer owes you the money and that the checking balance has decreased by the same amount.

Question (163):-

Suppose you always want all reports to show a specific size and color, how do you set the standard or preference in QuickBooks so you don’t have to customize each report?

Answer:

Click the Edit menu and select preferences to click the reports and graphs group to set your report preferences.

Question (164):-

Suppose you want to restrict which users can access customer credit card numbers. How do you do this?

Answer:

Give the user access to sales and accounts receivable but do not check the complete credit card numbers.

Question (165):-

Which accounts are affected when you enter time in QuickBooks?

Answer: Accounts Receivable

Question (166):-

If you have a customized report that you use each month, which features let you run their ports with updated data each month?

Answer: Memorize Report

Question (167):-

What is the primary reason for setting a closing date in QuickBooks?

Answer:

To restrict users from deleting, editing, or adding transactions to last year.

Question (168):-

Your new employee earned an annual salary of $40,000. How do you enter this into QuickBooks?

Answer: Enter 40,000 in the payroll info window.

Question (169):-

What steps must you complete to use the payroll center to pay payroll liabilities?

Answer: Set deposit frequencies

Question (170):-

Name the section of the Balance Sheet

Answer: Assets, Liabilities & Equity

Question (171):-

When you create a new company file, QuickBooks asks for your start date. What is the best definition of start date in QuickBooks?

Answer:

The day you choose to start recording the financial records in QuickBooks.

Question (172):-

How do you use a different forms template when creating a new transaction? (i.e. Invoice)

Answer:

Open the form, click the templates dropdown list and select the appropriate form.

Question (174):-

How do you change the report basis, accrual vs. cash for just one report?

Answer:

Click the modify report button on the report and then choose accrual or cash on the display pad.

Question (175):-

How would you track customer birth dates in QuickBooks?

Answer: Add a custom field to the customer list.

Question (176):-

How do you change the text in the header/footer of a report?

Answer:

Click the modify report button on the report and then change the header/footer tab.

Question (177):-

Where can you see a thumbnail sample of each report in QuickBooks along with a description of what the report tells you?

Answer: Report center.

Question (178):-

What transaction in QuickBooks should you use if your customer pays you when you provide the goods or services?

Answer: Sales Receipt.

Question (179):-

How can you ensure that invoice detail does appear on a customer statement?

Answer:

Uncheck the show invoice item detail on the statement’s box in the create statements window.

Question (180):-

What is the purpose of backing up in QuickBooks?

Answer:

To protect against data loss from file corruption or a hard file crash.

Question (181):-

How do you add or delete columns on a report?

Answer:

Click the modify report button and on the display tab check or add or uncheck remove columns.

Question (182):-

When should you use the items tab on a bill or check?

Answer: When you purchase inventory parts.

Question (183):-

When you are setting up a service item, what happens if you select the box next to this “service is performed by a subcontractor or partner”?

Answer:

QuickBooks provides fields so you can track purchase and sales information for that item.

Question (184):-

The Product Information window shows you the version and release of QuickBooks you have along with other information about the company file. How do you access the Product Information window?

Answer: Press the F2 key.

Question (185):-

When making your payroll tax deposit, how can you add IRS interest and/or penalties?

Answer:

Click the Expense tab and enter the appropriate account and amount of interest and penalties.

Question (186):-

When can you delete a check from QuickBooks without voiding it?

Answer:

You entered a check-in QuickBooks but haven’t printed it yet. You realize the purchase was made using a credit card. The check was never really used.

Question (187):-

What tool do you use to move your logo to a form?

Answer: Layout Designer.

Question (188):-

What is the reason for not being able to delete a list entry?

Answer: The entry has been used in a transaction.

Question (189):-

How do you move list entries to a different location on the list? For example, customers.

Answer:

Click on the diamond to the left of the name and then drag the name up or down the list.

Question (190):-

Assume that QuickBooks is now in Single User Mode. What does this mean?

Answer: Only one user can access the data file.

Question (191):-

How can you ensure that the invoice details are on a customer statement?

Answer: Turn on invoice detail in the customer statement window.

Question (192):-

How can you open a QuickBooks report in Microsoft Excel?

Answer: Click the Export button on the top of any QuickBooks report.

Question (193):-

What is the Accountants’ copy?

Answer:

A copy of a company file that allows the accountant to review and make adjustments while you can continue to work in QuickBooks.

Question (194):-

What 2 steps do you follow to track accounts payable in QuickBooks?

Answer: Enter bills, pay bills

Question (195):-

How do you hide subaccounts on a report?

Answer: Click the collapse button.

Question (196):-

Your company had to return some goods to a vendor. How do you record the vendor credit in QuickBooks?

Answer: Enter bill then click credit on top of the bill.

Question (197):-

What do you use to narrow the data QuickBooks displays on a report?

Answer: Filter.

Question (198):-

Once the Easy Step interview is complete, how do you change the company information for the business name, address, or phone number?

Answer: Select File, Easy step interview.

Question (199):-

What are the Undeposited Funds accounts in QuickBooks?

Answer:

An account is used to record payments before you make a deposit.

Question (200):-

What is the result of a payroll setup interview?

Answer:

QuickBooks has an accurate record of employees, earing deductions, and payroll history and you are ready to create the first paycheck.

Question (201):-

You finished entering all the transactions for last year, and just send the file to the tax preparer. How do you assure that no one accidentally deletes or edits a transaction last year?

Answer:

Set the closing date and password in the accounting preferences in the company menu

Question (202):-

How do you identify the version and release of QuickBooks you have?

Answer: Press the F2 button.

Question (203):-

When you set up a new employee, how do you add a payroll deduction such as medical insurance?

Answer:

In the new employee window, click the change tab drop-down list and select payroll and compensation info, and then add the medical insurance payroll item below the additions deductions and company contributions.

Question (204):-

When should you VOID instead of deleting a check?

Answer: You used the check number but it will never be cashed.

Question (205):-

How do you pay payroll liabilities in QuickBooks?

Answer:

Select payments you want to make from the pay schedule liabilities in the payroll center then click view pay.

Question (206):-

How do items affect the financial statement?

Answer: When you purchase or sell an item the value of the on-sale purchase flows to the account

Question (207):-

You accidentally entered the same customer twice in the customer center with a slightly different spelling. How do you merge these entries?

Answer:

Edit the unwanted list entry, change the name you want to merge, and click ok, then yes when prompted to merge.

Question (208):-

How do you record debit card transactions in QuickBooks?

Answer:

Use the write checks window, enter the check and write debit the check number field.

Question (209):-

Which is a reason to NOT enter a general journal entry?

Answer:

To enter transactions in another way instead of using forms.

Question (210):-

The bank notifies you that a customer’s check you deposited has bounced. The customer does not have sufficient funds to cover the check. What should you NOT do?

Answer: Delete the customer payment from the deposit.

Question (211):-

How do you display a group of reports?

Answer: Click the reports menu then select process multiple reports.

Question (212):-

Which payroll service allows you to print state tax forms?

Answer: Basic payroll

Question (213):-

How do you customize a report, i.e. change the information QuickBooks displays, change the title, etc?

Answer: Click the modify report button on the report.

Question (214):-

A list entry may be deleted only when…

Answer:

It has no balance; it has not been used and is not linked to anything that has been used.

Question (215):-

Your company provides its employees with sick/vacation hours. You need to track how many hours each employee currently has available, how many they add or accrue and you need to reduce their accrued hours when you pay them for sick or vacations time. How would you do this in QuickBooks?

Answer:

Click the vacation button on the employee set up to define how to accrue time and tell QuickBooks how many hours the employee is available. When you pay an employee for sick/vacations time, click the sick/vacation button and reduce those available hours.

Question (216):-

When you send a QuickBooks report to Excel, which features allow you to choose what sections of the report to collapse?

Answer: Auto outline.

Question (217):-

What is the purpose of an Audit Trail report?

Answer:

Track any changes and deletions to transactions and track which user makes the change or the deletion.

Question (218):-

What can you do in the report center?

Answer: Run most reports in QuickBooks

Question (219):-

The company file you are working on is a mess. You decided to start a new file. At the same time, you want to keep all the lists and preferences and just delete the transactions. How do you do this?

Answer:

Click the File menu, choose Utilities, clean up company data, then choose the default transaction option.

Question (220):-

Your company sells unique items to every customer. They never sell the same service or product twice. What item should you set up in QuickBooks?

Answer:

Set up a generic item and edit the description and price each time.

Question (221):-

You hired a subcontractor to work 40 hours per week. Which list should you add this person to?

Answer: Vendors.

Question (222):-

When should you enter a customer credit memo?

Answer: When the customer returns a product that is damaged.

Question (223):-

How do you make a column on a report wider?

Answer:

Click the diamond to the right of the column and drag it to the right.

Question (224):-

When you run a profit and loss on an accrual basis what does QuickBooks include as income?

Answer: All sales.

Question (225):-

What is the quickest way to find an invoice from 6 months ago?

Answer:

Open an invoice and click the find button. Open an invoice and click the find button.

Question (226):-

Which tool do you use to modify where QuickBooks displays elements on a printed form or template?

Answer: Layout designer.

Question (227):-

How do you make an item on the item list inactive?

Answer:

Open the item list, click to select the appropriate item, then click the bottom left button and select item inactive.

Question (228):

QuickBooks Online has some great features. Clients can use Online Invoicing, which will track when they’ve been viewed and paid. Online Invoicing even allows for customer queries via online messages directly linked to the invoice. You now need to enable this feature in the new client company you’re setting up.

Take a look at the steps below.

1. Select the Gear icon, and select Account and Settings, under the Your Company column

2. _____________ and scroll down to the Online delivery section

3. _____________ to ensure that Attach invoice as pdf is unchecked

Can you identify the missing steps?

Answer: Step 2: Select the Sales tab; Step 3: From the drop-down list, select Online invoice

Question (229):

Your client has asked you to turn on warnings for duplicate check and bill numbers in their QuickBooks Online company.

Take a look at the steps below.

1. ______________

2. Under Your Company, select Account and Settings

3. Select the Advanced tab

4. In the Other preferences section, select the option to warn if a duplicate check number is used and warn if a duplicate bill number is used

5. ______________

Starting at the QuickBooks Online Dashboard, which option would complete the following steps?

Answer: Step 1: Select the Gear icon; Step 5: Select Save

Question (230):

Your client doesn’t want to pay a monthly fee for their QuickBooks Payments merchant account. What other option is available to them, and wherein QuickBooks Online can they sign up for QuickBooks Payments?

Answer: There is another plan which means the customer pays the transaction charge; In the Billing and Subscription tab of Account and Settings.

Question (231):

Your client has moved and needs you to modify the business address of the company in QuickBooks Online.

Take a look at the steps below.

1. Sign in to your QuickBooks Online Accountant account

2. _________________

3. You’ll see the client company dashboard

4. _________________

5. Select Account and Settings

6. Select the Pencil icon in the Address section of the Company tab

What are the missing steps to get you to the screen to edit the address for your client?

Answer:

Step 2: Select the client company from the Client Switcher drop-down in the green header bar

Step 4: Select the Gear icon

Question (232):

A great feature of QuickBooks Online is that there are other lists you can utilize to make it easier to fill in forms. Where would you go to find these lists?

Answer: Go to the Gear icon and select All Lists

Question (233):

Where can you go in QuickBooks Online to import a list of products and services?

Answer: Select the Gear icon and under the Tools column, select Import Data, then Products and services

Question (234):

A small business owner already has an Intuit ID and is going to set up their own QuickBooks Online company. Below are a series of steps for setting up a new QuickBooks Online company.

1. Go to QuickBooks.com

2. Select the appropriate subscription level

3. Select Sign in

4. ________________

5. Select Sign in

Can you identify the missing step 4?

Answer: Step 4: Enter an Intuit ID email address and password

Question (235):

Below are a series of steps for accepting an invitation from the client to become their accountant user.

1. Open the email account you use for your Intuit ID

2. You will see an invite from the client company

3. Select the Accept button to accept the invitation

4. ________________________ and you’ll see a Success! box

5. Select Continue

Can you identify the missing step?

Answer: Step 4: Sign in to your QuickBooks Online Accountant account

Question (236):

Look at the following 2 statements:

- Statement 1 – “QuickBooks Online _____________ is the do-it-for-me option; a complete payroll service with a team of US-based payroll experts to take care of payroll for your client.”

- Statement 2 – “You can also link up ____________ with QuickBooks to simplify workflow and save yourself a significant amount of time. You’ll benefit from a seamless, end-to-end experience that translates a client’s QuickBooks Online books into a tax return.”

Identify the products that fit in the spaces to correctly complete the statements.

Answer: Full-Service Payroll; ProConnect Tax Online

Question (237):

The Chart of Accounts lies at the heart of a QuickBooks Online company. Which 5 of the following statements are true about the Chart of Accounts, how to make changes to the Chart of Accounts, and how products and services are linked to the Chart of Accounts?

Answer:

- To add a new account, you open the Chart of Accounts by selecting Accounting from the left navigation, then select New to open the Account window

- The Sales of Product Income account is a default account when inventory is turned on

- If you add a new account, the category type determines on which financial statement this account will show

- When we set up Products and Services, they are linked to the Chart of Accounts by specifying a sales price/rate

- Delete an account from the Chart of Accounts if it is not relevant to your business

Question (238):

To set up a new bank feed or link to a bank account in a client’s QuickBooks Online company you should go to the ___________. If it’s the first time you’ve been here, select Connect, otherwise select Add account. Which option completes the statement?

Answer: Banking Center

Question (239):

If you want to give one or more of your employee’s access to Your Practice, what types of user permissions can be set up?

Answer: Regular or custom user, Company administrator, Reports only and Time Tracking only

Question (240):

You’ve been asked to add a new customer for your client in their QuickBooks Online company, so, you go to the Sales Center and select the Customer tab to begin. As this is the first customer for your client you are taken straight to an easy entry screen.

Take a look at the steps that follow:

- You enter the customer name, phone number, and email from the business card you’ve been given by the client

- ____________________

- You now want to edit this customer’s details to add some further information

- Select the customer name from the customer list

- Select the Edit button in the top right

- This customer is not taxable and you need to enter their reseller number. Select the Tax info tab and enter their reseller number 92-12345 in the Exemption details for the employee tax exemption in QuickBooks.

- ___________________ and set their preferred payment method to Credit Card

- Select Save

- Now select the missing steps.